Every penny matters. Knowing what relief can be applied to your business and potentially combining a number of relief measures can add up to considerable tax savings.

There’s a range of tax relief available for small and medium businesses, some less known than others. Below Tomasz, from SAFI Advisory Services, has listed a few that have helped his customers reduce their tax obligations considerably.

Making expenses simple if you’re self-employed

A large number of self-employed people are using their own car for business purposes and to work from home. The business proportion of vehicle running costs as well as costs of heating, electricity, etc. are tax allowable. Nevertheless, many individuals choose not to claim as figuring out the right proportion can be quite difficult and HMRC requires businesses to keep records to justify used figures. There are, however, simplified expenses that allow self-employed people to use a simple flat-rate as tax-deductible expenses.

If you’re self-employed and using your vehicle for business purposes, then you can claim flat-rate mileage allowance, which is 45 pence per mile for up to 10,000 miles in a tax year (25p for additional miles). Lower rate of 24 pence per mile is available for motorbikes. You should keep records of business trips (date, where from, where to, number of miles, reason).

Mileage allowance can be used instead of working out actual expenses. Remember that once you decide to use flat rate expenses, you must continue to do so as long as you use that vehicle for your business.

If you are self-employed and working from home, which is much more common nowadays, then you can use the flat rate allowance. The flat rate does not include telephone or internet expenses, which can be claimed separately. How much you can claim depends on the number of hours worked each month:

Hours of business use per month and the flat rate per month

25 to 50 = £10

51 to 100 = £18

101 and more = £26

'Simplified expenses' – limited companies

Very similar allowances can also be claimed by employed directors for their own limited companies.

The employer (your limited company) can pay an employee (this includes you as an owner/director) mileage allowance for the use of a private vehicle for business purposes (45 pence per mile up to 10,000 miles in a tax year and 25 pence per mile for additional miles). Business trips can include travelling to clients, but also short trips such as driving to local stores to buy stationery required for work. It is less commonly known that tax relief can be claimed for bicycle mileage, at the rate of 20 pence per mile. So even if you use a bike for your business trips you can build up quite a substantial tax relief over a year.

Remember that trips between your residence and usual place of work are not tax-deductible. Companies do not need to report mileage payments at an approved rate (up to the allowance) to HMRC but can choose to include mileage in their monthly payroll. Employees (including you if you operate PAYE system) receive those payments free of tax.

If an employee is required to work from home, the employer can pay an employee £6 per week (or £26 per month) to cover '’use of home’ expenses. It might seem like a small amount, but over the year, it can add up to £312, which is tax-free.

Employing someone – applies to both self-employed and limited companies

Eligible small businesses that operate PAYE and employ people can claim Employment Allowance. Employment Allowance allows eligible employers to reduce their annual National Insurance liability by up to £4,000.

Employer's National Insurance is charged at the rate of 13.8% on top of the employee's gross wage on earnings above £732.01 per month (or £169.01 per week). Therefore on someone's gross wage of £1,732.01, the Employer's National Insurance adds an extra £138 of PAYE tax that the company must pay. The allowance can build up to a significant relief. It can’t be claimed when a company employs only a single director, but it can be claimed when a company employs at least one employee who is not a director, at least two directors or director and at least one employee.

Therefore it’s sometimes worth considering engaging your partner in helping you to run your business, but this depends on other circumstances. Nevertheless, it’s important to remember that when your business is eligible you must make a claim, it’s not done automatically. An Employment Allowance claim is made through payroll software.

Owning or renting premises

Businesses that own or rent their premises, which are subject to business rates, can claim small business rate relief that can even reduce their business rates to zero.

You can get small business rate relief if your property’s rateable value is less than £15,000 and your business only uses one property (you may still be able to get relief if you use more than one property in some circumstances). You will not pay business rates on a property with a rateable value of £12,000 or less. For properties with a rateable value of £12,001 to £15,000, the rate of relief will go down gradually from 100% to 0%.

Reliefs for limited companies – research and development and artistic design reliefs

The UK has very generous and helpful tax rules for companies involved in researching new products, innovating as well as for businesses involved in artistic development, such as movie making or computer games design.

Research and Development (R&D) Tax Credits

Small or medium-sized enterprise (SME) R&D tax relief allows companies to deduct an extra 130% of their qualifying costs from their yearly profit, as well as the normal 100% deduction, which makes a total 230% deduction.

For businesses that ended up in a loss, which is not uncommon in first years of starting up a business, there is a choice of surrendering the loss to claim tax credit instead, worth up to 14.5% of the surrenderable loss. This cash injection is a great help to improve business' cash flow at the development stage before a new idea turns into a profit-making enterprise.

To claim the relief you need to be an SME and show how your project meets the definition of R&D, which means that your project should amongst other criteria:

Look for an advance in science or technology and aim to achieve this advance

Have had to overcome scientific or technological uncertainty

Could not easily be worked out by a professional in the field

You can claim R&D tax relief if you’re an SME with less than 500 staff and a turnover of under €100m or a balance sheet total under €86m.

From the date you start working on the project until you develop or discover the advance, or the project is stopped, you can claim certain costs on:

A proportion of salaries for staff working directly on the R&D project, Class 1 NI contributions and pension fund contributions

Administrative or support staff who work to directly support a project

65% of the relevant payments made to an external agency if they provide staff for the project

65% of the relevant costs of using a subcontractor for your R&D activities

Software licence fees bought for R&D and a reasonable share of the costs for software partly used in your R&D activities

The relevant proportion of consumable items used up in the R&D. This includes, materials, utilities, clinical trials volunteers

You cannot claim for:

The production and distribution of goods and services

Capital expenditure

The cost of land

The cost of patents and trademarks

Rent or rates

You can make a claim for R&D relief up to 2 years after the end of the accounting period it relates to. You can claim the relief on the full Company Tax Return form (CT600).

If your company has external investors, this can affect your SME status. You cannot claim SME R&D relief if the project is already getting notifiable state aid or you’ve been subcontracted by another company. However, you may be able to claim the R&D Expenditure Credit (RDEC).

Creative industry tax reliefs are a group of 8 corporation tax reliefs that allow qualifying companies to increase their amount of allowable expenditure. This can reduce the amount of corporation tax the company needs to pay. If your company makes a loss, you may be able to surrender the loss and convert some or all of it into a payable tax credit.

Your company can claim creative industry tax reliefs if it’s liable to corporation tax and it’s directly involved in the production and development of either: films, high-end television, children’s television, animation television, video games, theatrical productions, orchestral concerts, museum or gallery exhibitions. It needs to be involved with decision-making and directly negotiates contracts and pay for rights, goods and services.

To qualify for creative industry tax reliefs, all films, animation and television programmes or video games must be certified as British. They must pass a cultural test or qualify through an internationally agreed co-production treaty.

The British Film Institute (BFI) manages certification and qualification on behalf of the Department for Digital, Culture, Media and Sport. The BFI will issue an interim certificate for uncompleted work or a final certificate where production has finished,

Tax reliefs allow an additional deduction of up to 80% of total core expenditure or for loss-making companies to surrender some or all of loss for a payable tax credit at a rate of up to 25%.

This article is meant to serve as a general guide and it does not form personalised tax advice. The article aims to raise awareness of available tax reliefs and to encourage businesses to seek more detailed information to find out if reliefs apply to them. It is recommended to speak to your own accountant and discuss the above matters in detail as every person's or company's circumstances can differ and claiming certain tax reliefs might affect other matters in the business.

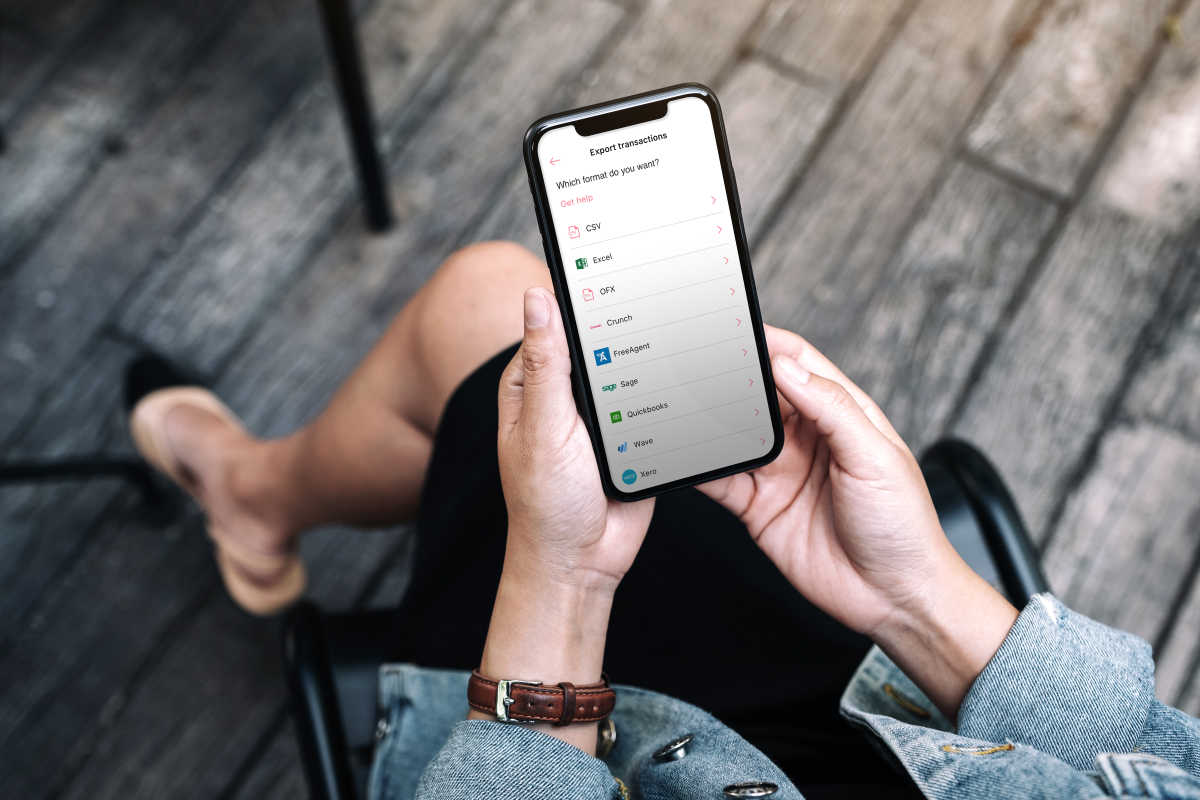

Interested in finding out more about Mettle? Check out the features of Mettle's business bank account.

Relevant links

Research and Development tax relief for small and medium-sized enterprises

Expenses and benefits: business travel mileage for employees' own vehicle