Pots

Start saving at your own pace. You can add as much or as little as you'd like from your main account into a pot.

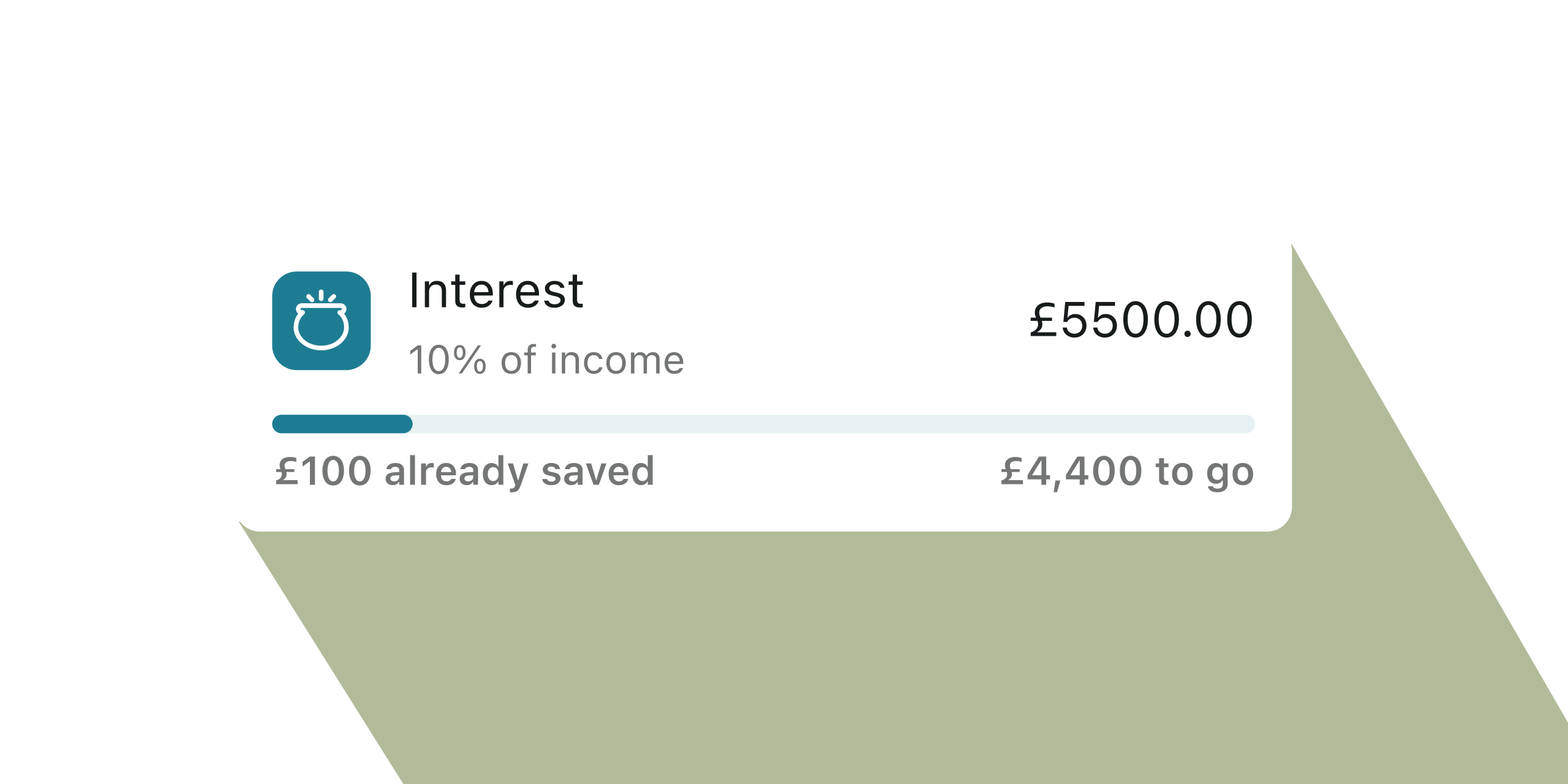

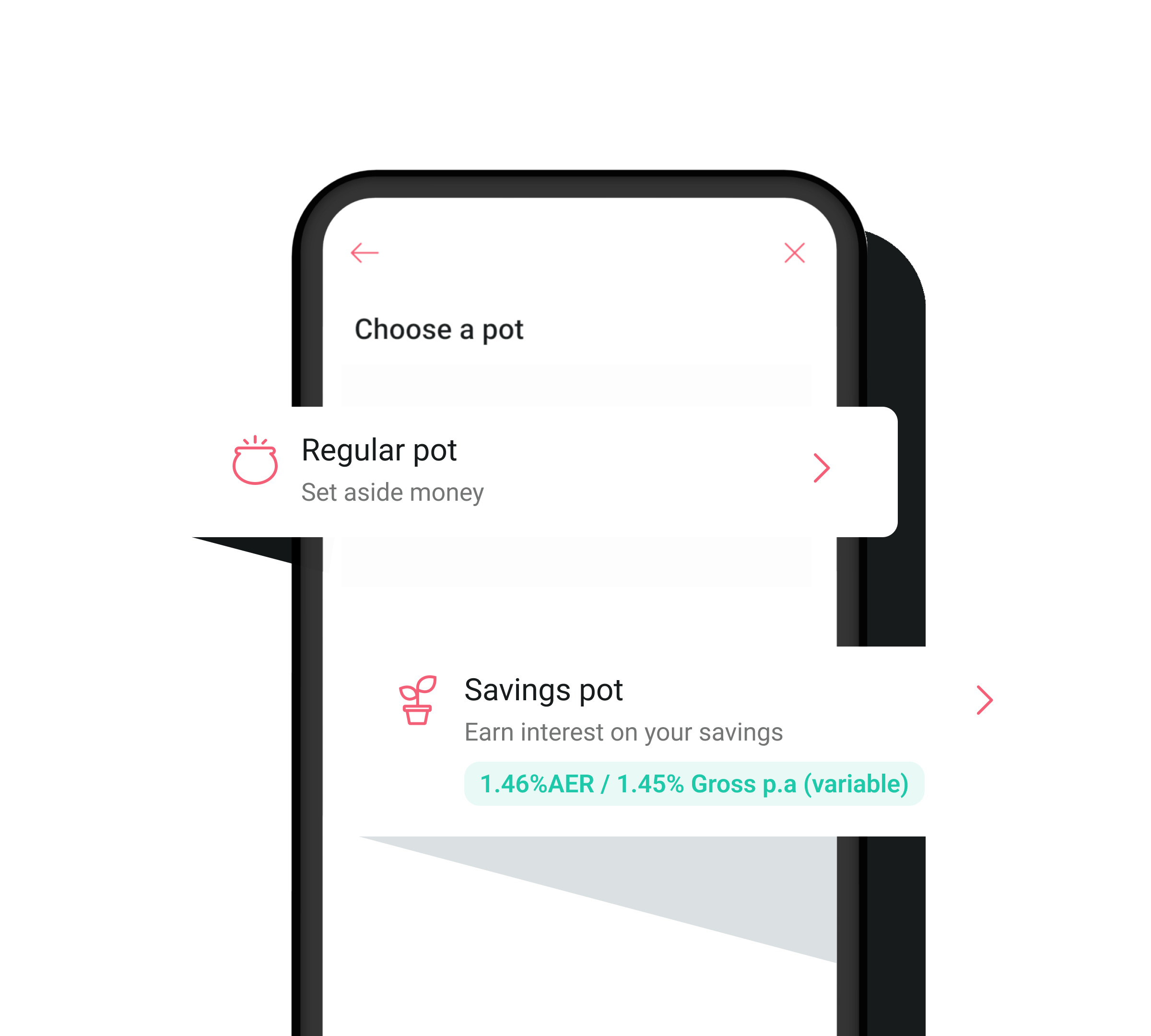

Savings pots

Earn 1.46% AER / 1.45% Gross p.a (variable) on balances from as little as £10.

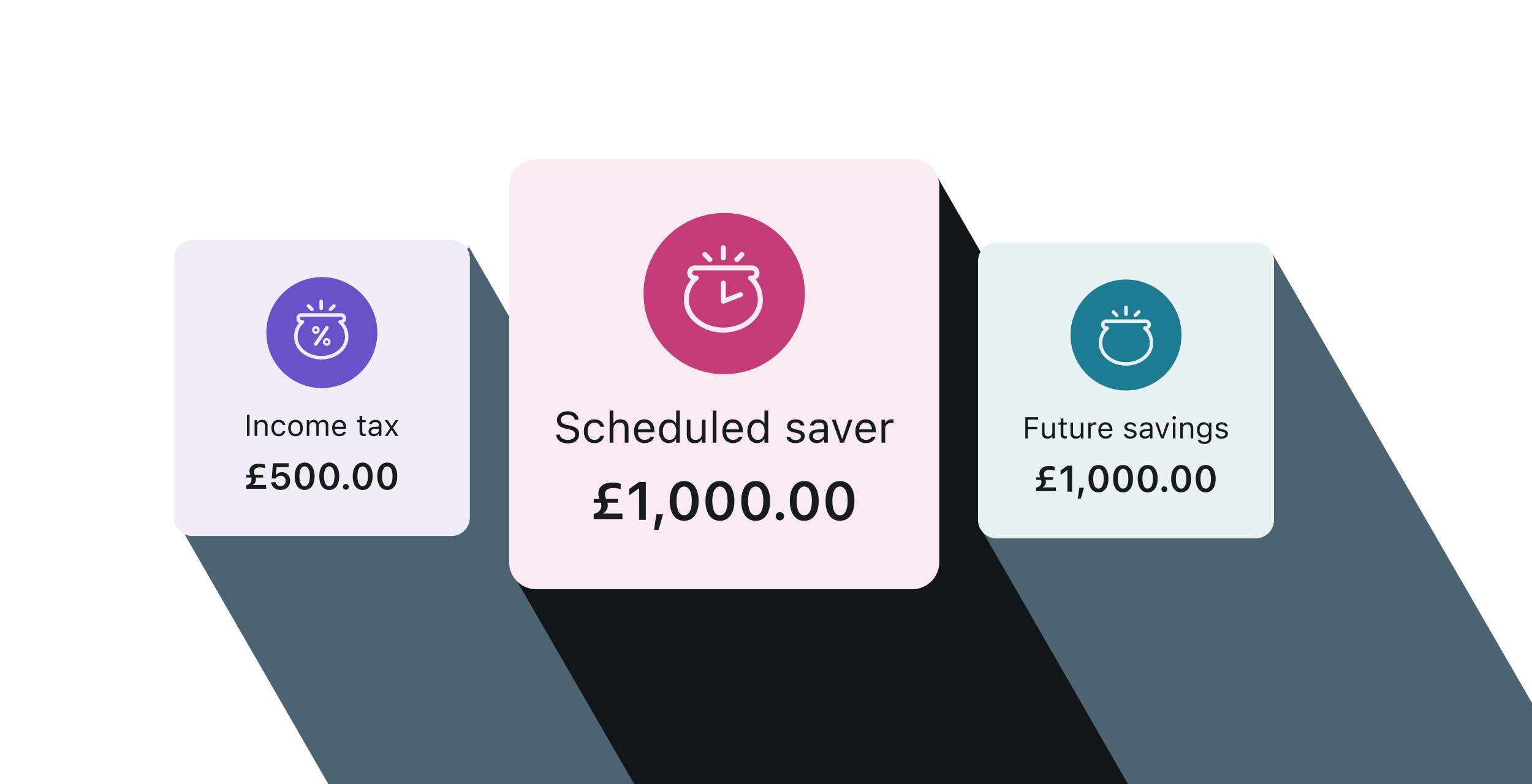

Regular pots

Easily put money aside from your main account to save for things like tax, business costs or new equipment.

Only savings pots can earn interest. You can only have one savings pot. It has a maximum balance of £1m. The interest rates may change to reflect the savings market. Interest is calculated daily and will be paid out monthly. Any positive change in interest will be notified within 30 days, any negative change in interest will be notified at least 60 days before. AER stands for Annual Equivalent Rate. It shows you what the rate would be if interest was paid and compounded each year. Gross is the interest rate you’ve paid without the deduction of UK income tax. p.a is per annum (per year). Read the full Mettle business account T&Cs here.

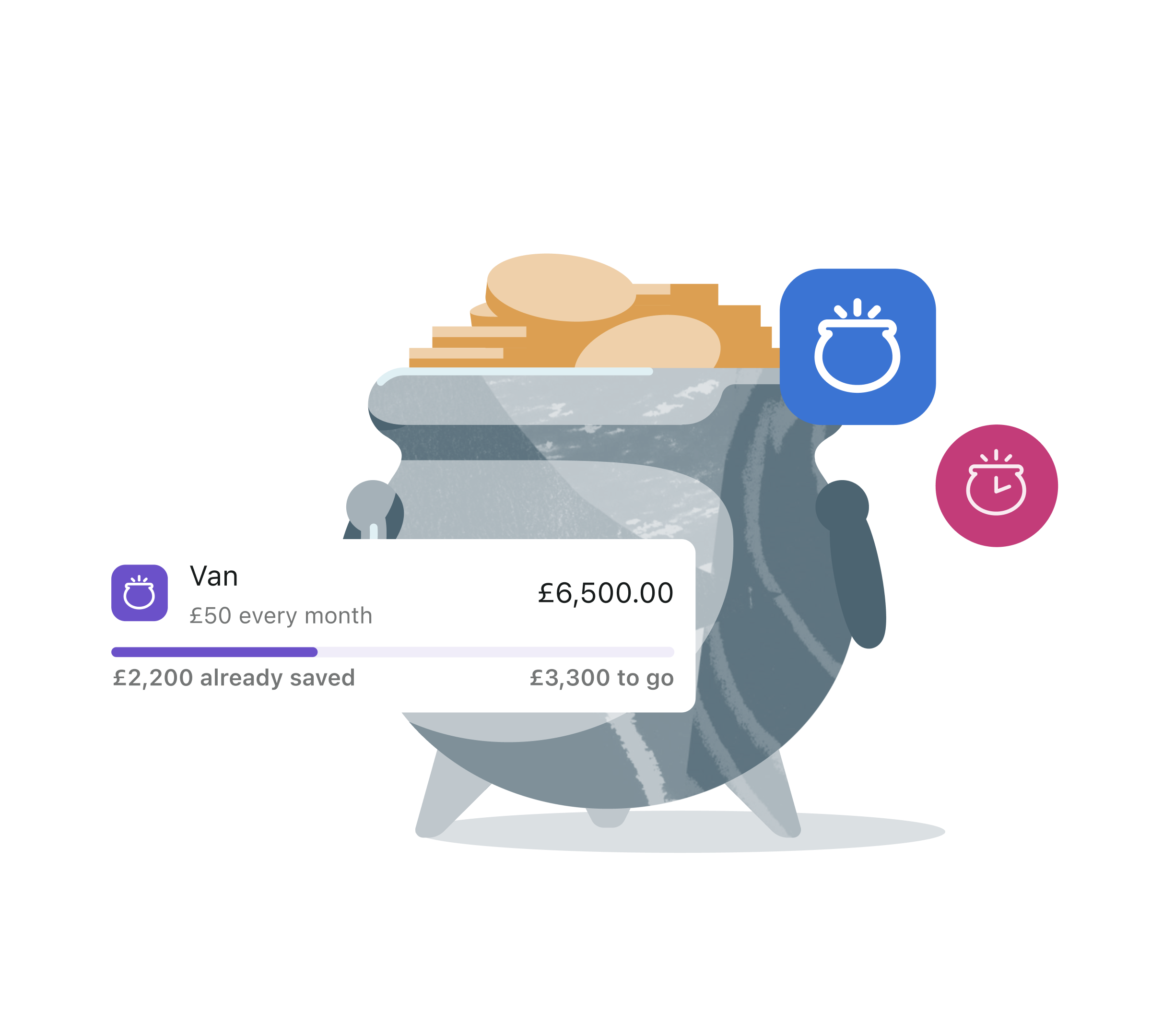

Pots' balance

Set aside up to £100k across all your regular pots and £1 million in your savings pot. This is in addition to the maximum limit of your main account.

How pots work

Create a pot

Tap ‘Create pot’ on the Home screen in your app. You can choose between a 'Savings pot' or a 'Regular pot'.

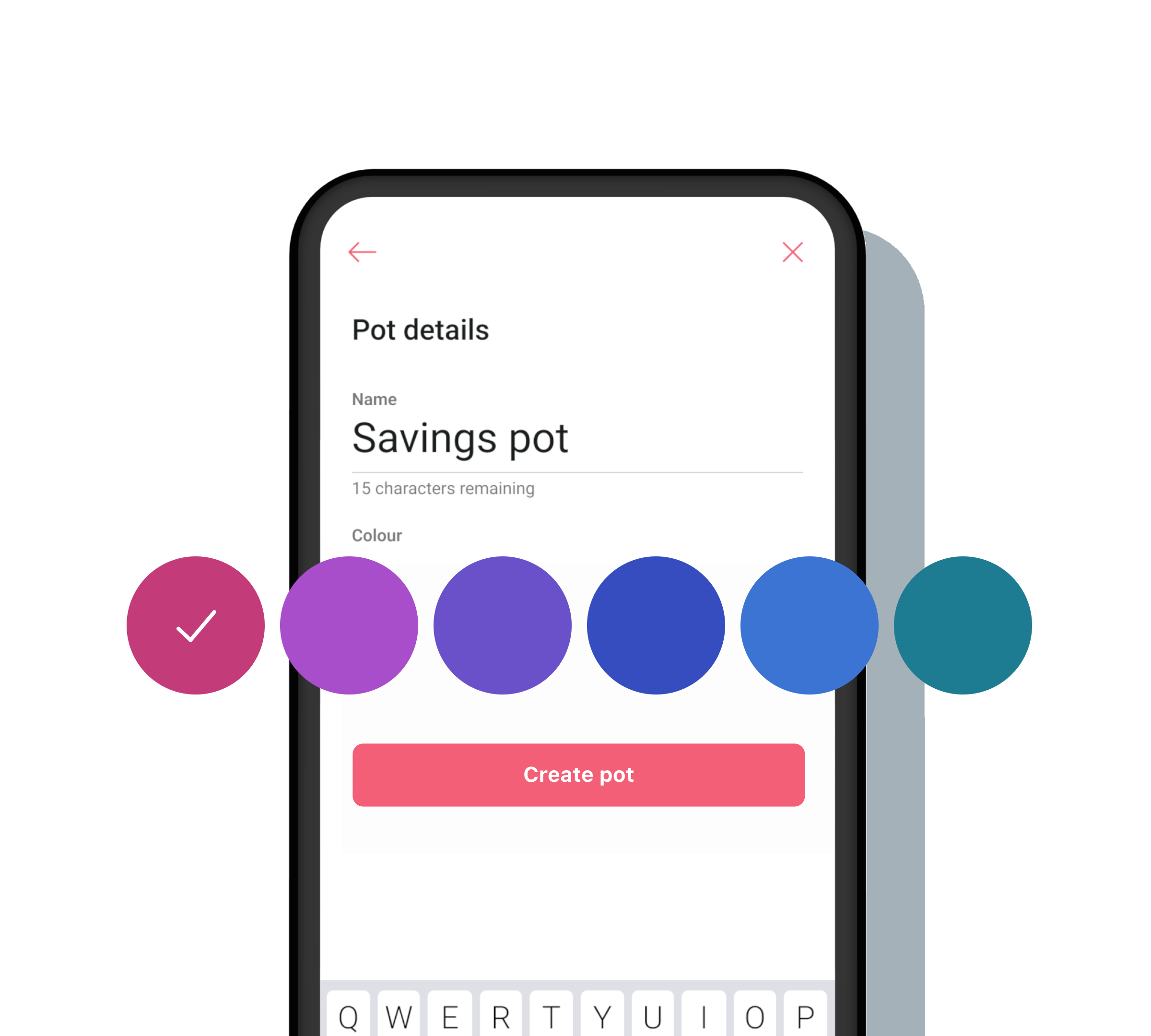

Customise your pot

Choose from several different colours and name your pot.

Automatically save with rules

Choose to transfer a percentage of your incoming transactions, or set a schedule to transfer a regular amount.

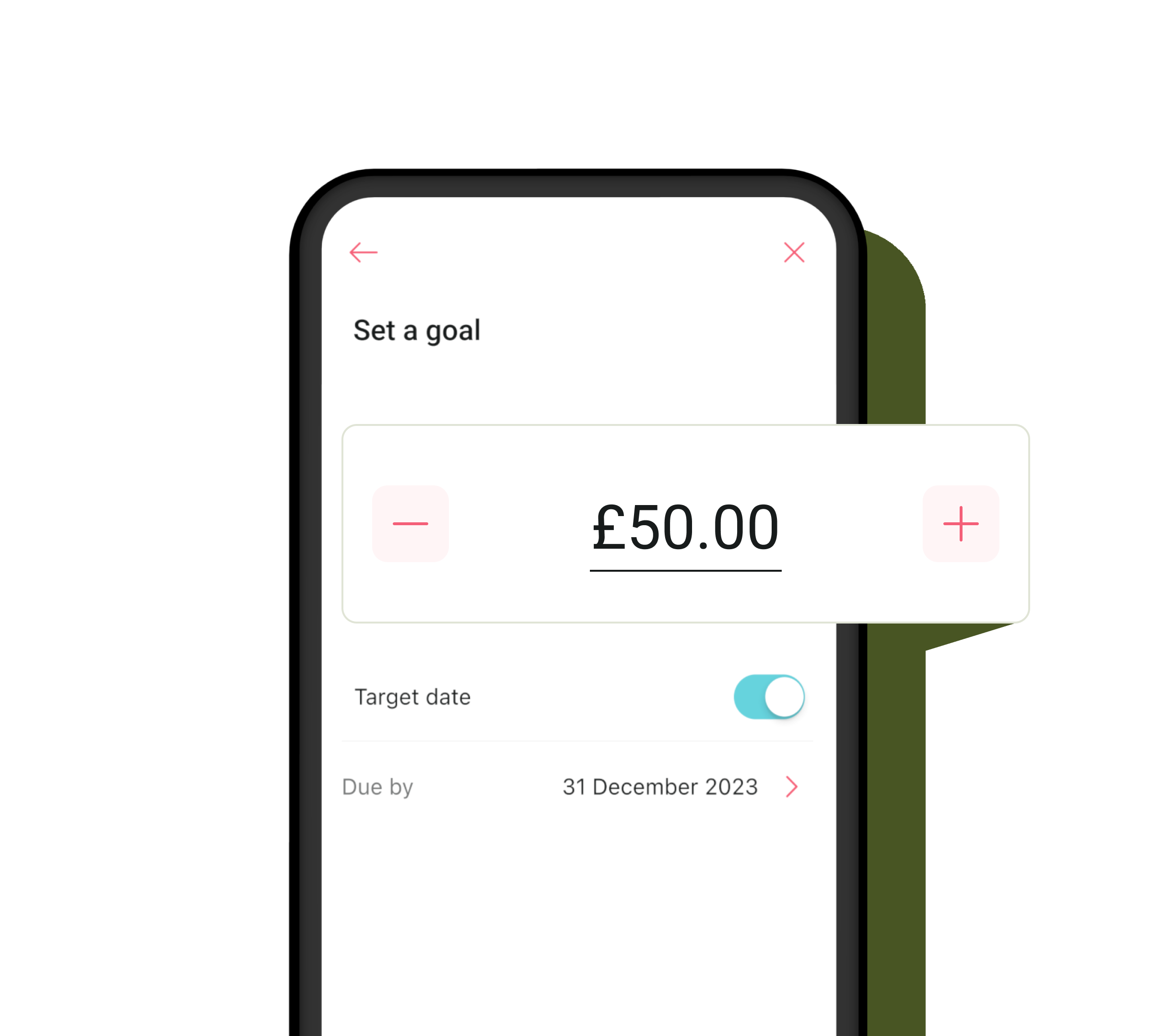

Set a goal

Once you've created a pot, keep track of your savings by adding a goal.

Find out more about Mettle's business bank account features

Frequently asked questions

How can I pay with pots?

If you want to use the money in one of your pots to make an external payment, you’ll need to transfer money into your main account and make the payment in the normal way.

Can I export my transactions?

You can export your Regular pots’ transactions and see your statements. You can find them under ‘Transactions and statements’ on your Account screen.

What is the difference between a savings pot and a regular pot?

A savings pot is the only pot which earns interest. You can only open one savings pot and the limit is £1 million. You can create up to 30 regular pots, as long as the total amount doesn’t exceed your regular pots balance limit of £100k.