MTD signup checklist: 5 steps to get ready before the deadline

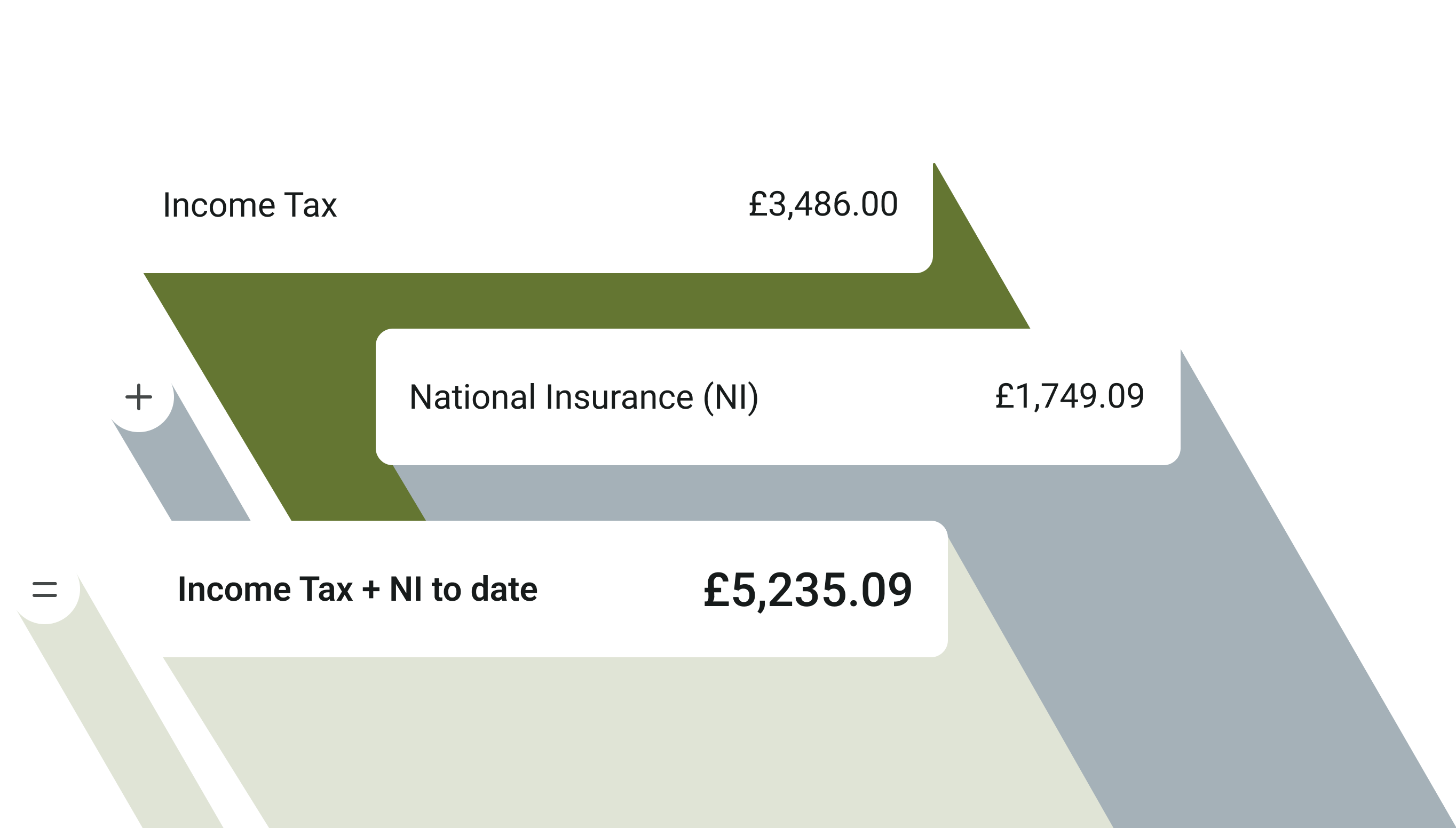

Avoid surprise tax bills with a rolling tax calculation right in your Mettle app. The tax calculation, powered by FreeAgent, gives you an up-to-date view of how much tax you’re likely to owe.

Get an up-to-date view of how much tax you’re likely to owe and when with the tax calculation powered by FreeAgent.

Sync your Mettle account with FreeAgent to get an accurate view of your tax position.

Take the hassle out of your business admin by automatically saving a percentage of your income, or scheduling a set amount of money to go into a tax pot.

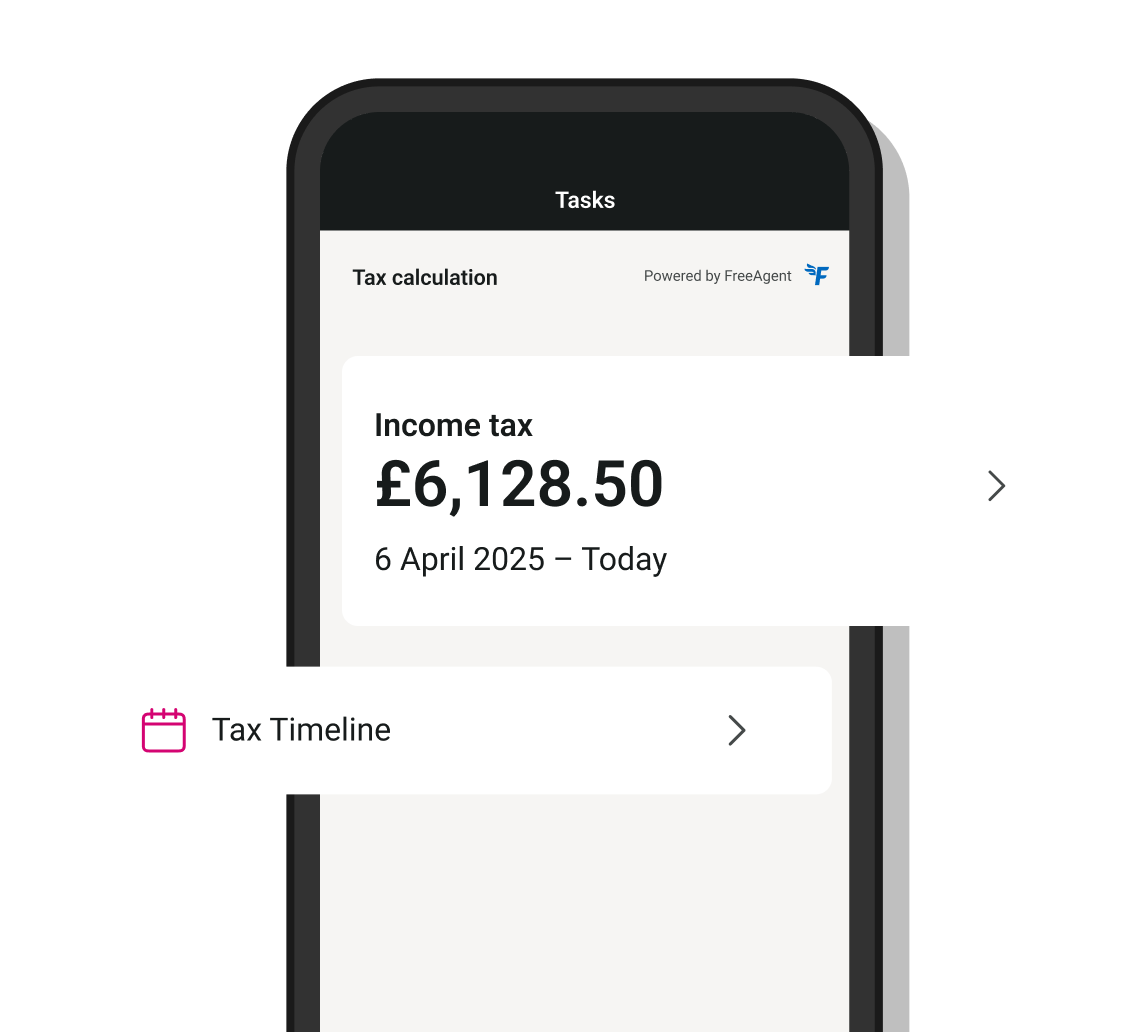

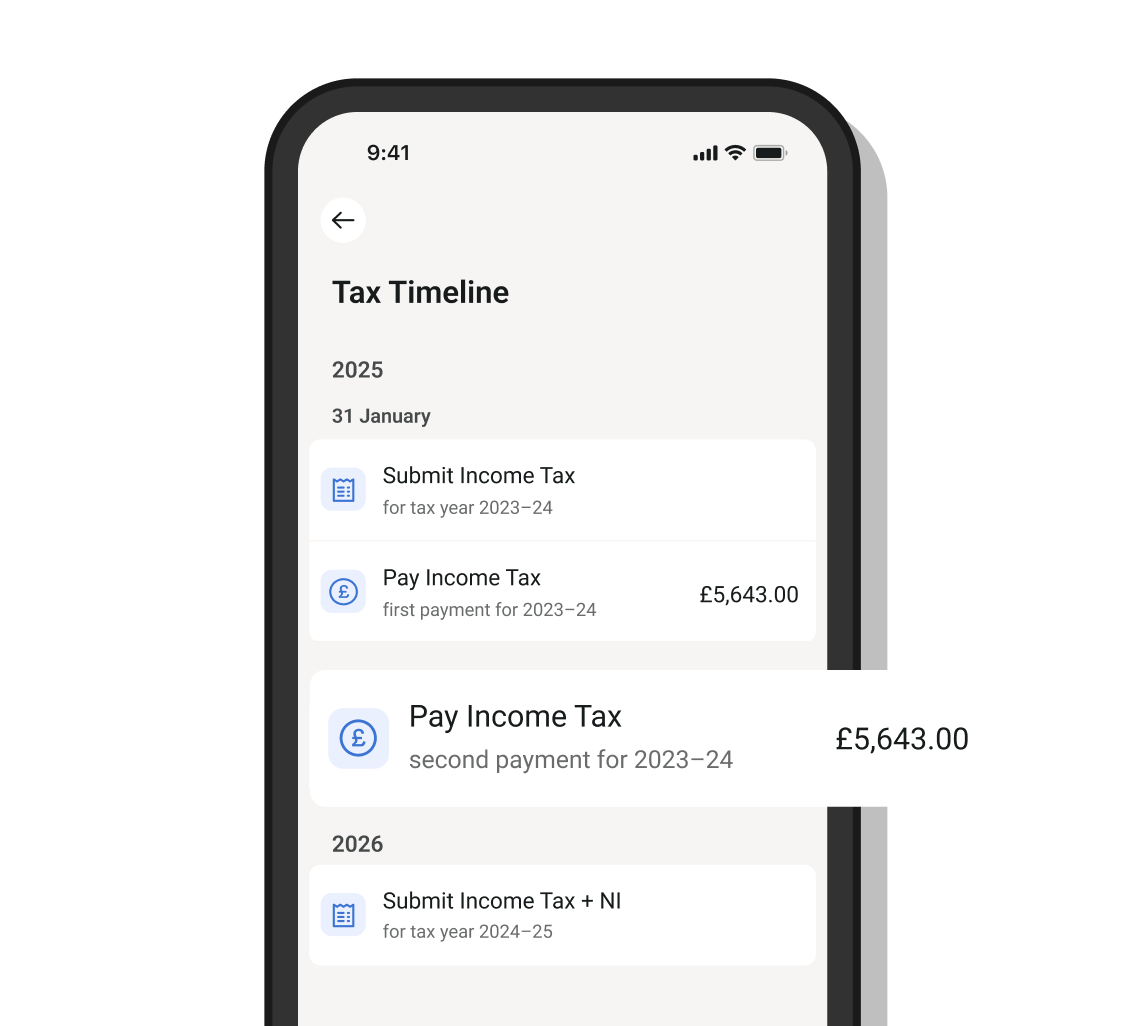

You’ll even get an up-to-date view of payment dates through the tax timeline.

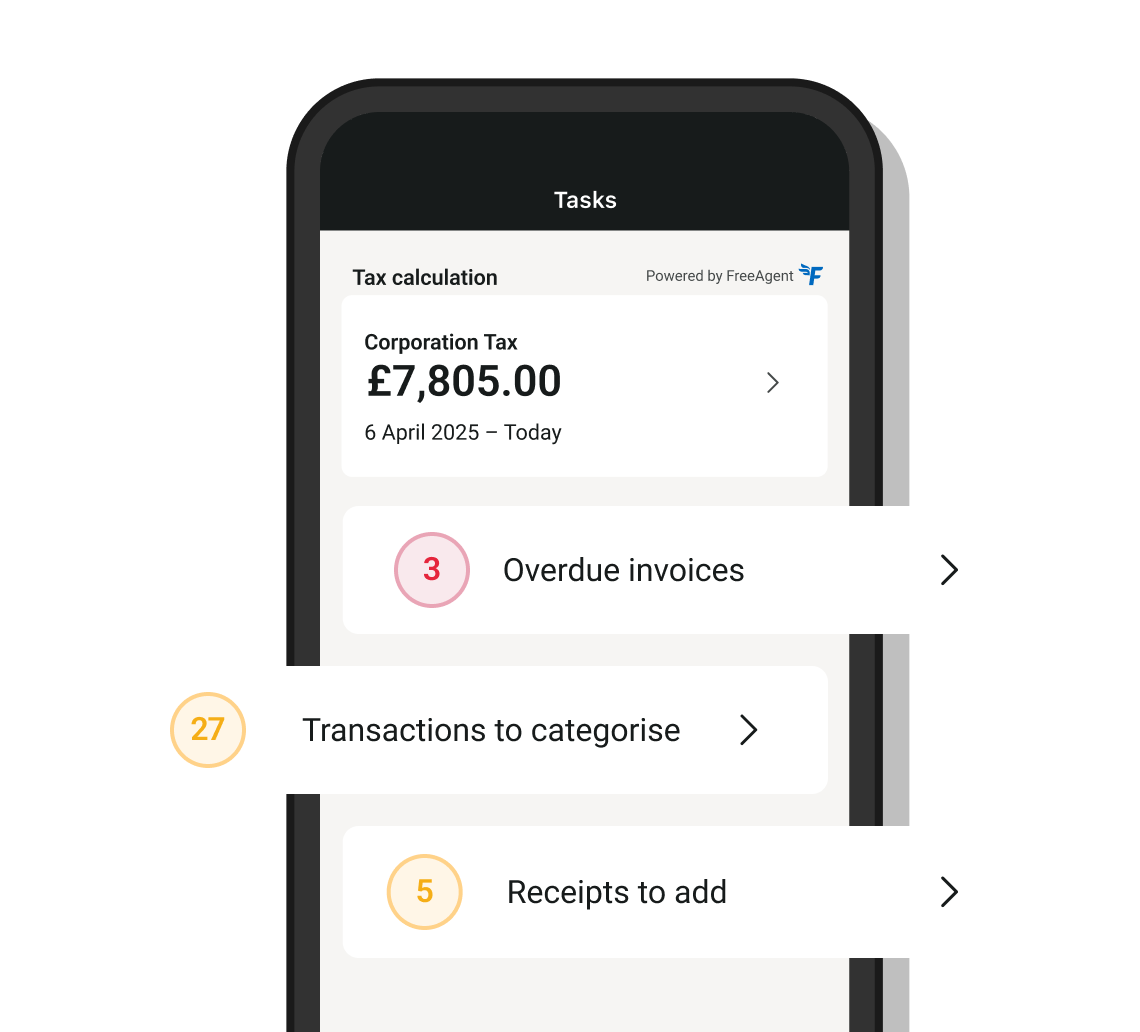

To get a more accurate view of how much tax you could owe, you'll need to complete all outstanding tasks in Mettle and FreeAgent.

When all tasks are completed, you'll get a real-time view of your calculation.

You can also see a timeline of what tax is likely due, and when.

Have a quick look at our eligibility criteria.

MTD signup checklist: 5 steps to get ready before the deadline

How to file a Self Assessment tax return

The role of the accountant in Making Tax Digital for Income Tax

What is Making Tax Digital and how will it impact you?

How to start an e-commerce business