MTD signup checklist: 5 steps to get ready before the deadline

Ready for Making Tax Digital (MTD) for Income Tax? Explore Mettle's features and take the hassle out of your tax submission.

Mettle is for sole traders and limited companies with up to two owners (only one owner can access the account). Only one account can be opened per person.

From April 2026, Making Tax Digital (MTD) for Income Tax will require most self-employed individuals and landlords with business or property income over £50,000 per year to keep digital records and submit quarterly updates to HMRC using compatible software.

The threshold for MTD for Income Tax will reduce to include income over £30,000 from April 2027, and income over £20,000 from April 2028.

Ditch the paper piles and embrace digital record-keeping. Using spreadsheets or accounting software, like FreeAgent (free with a Mettle account*), can significantly simplify your tax management and ensure you're MTD compliant.

Simplify your financial management with the right tools. FreeAgent accounting software is free* with your Mettle account and is MTD compliant.

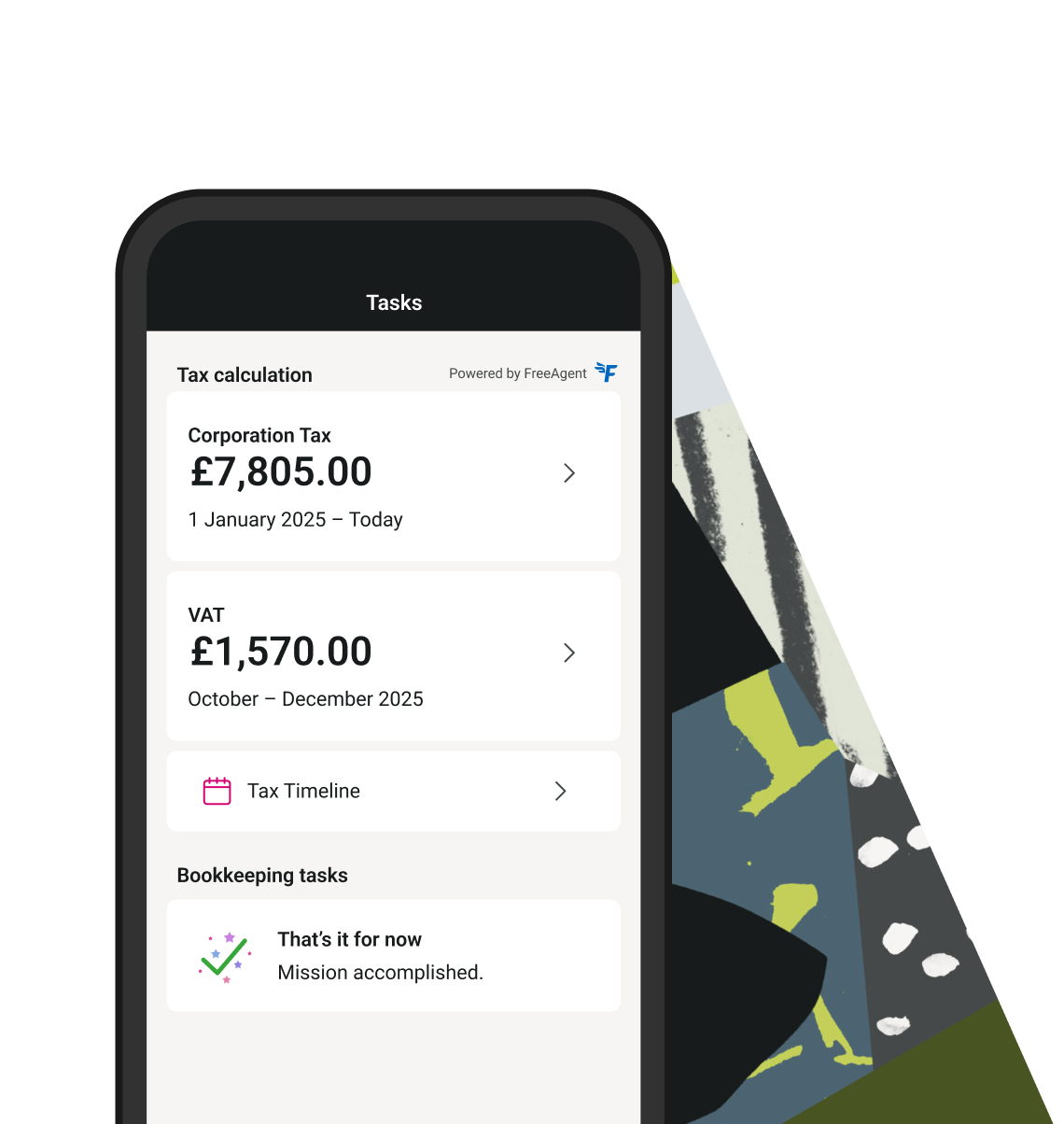

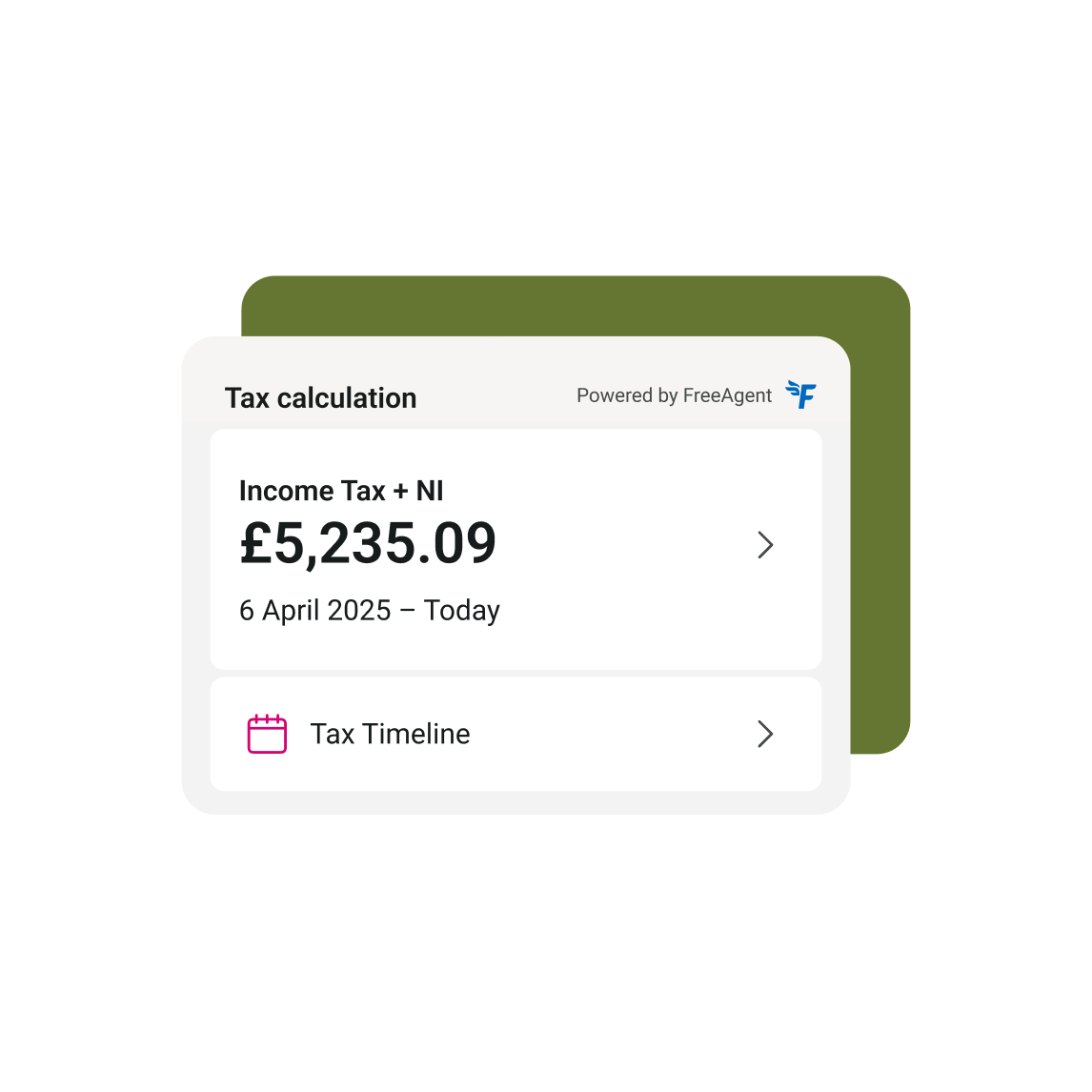

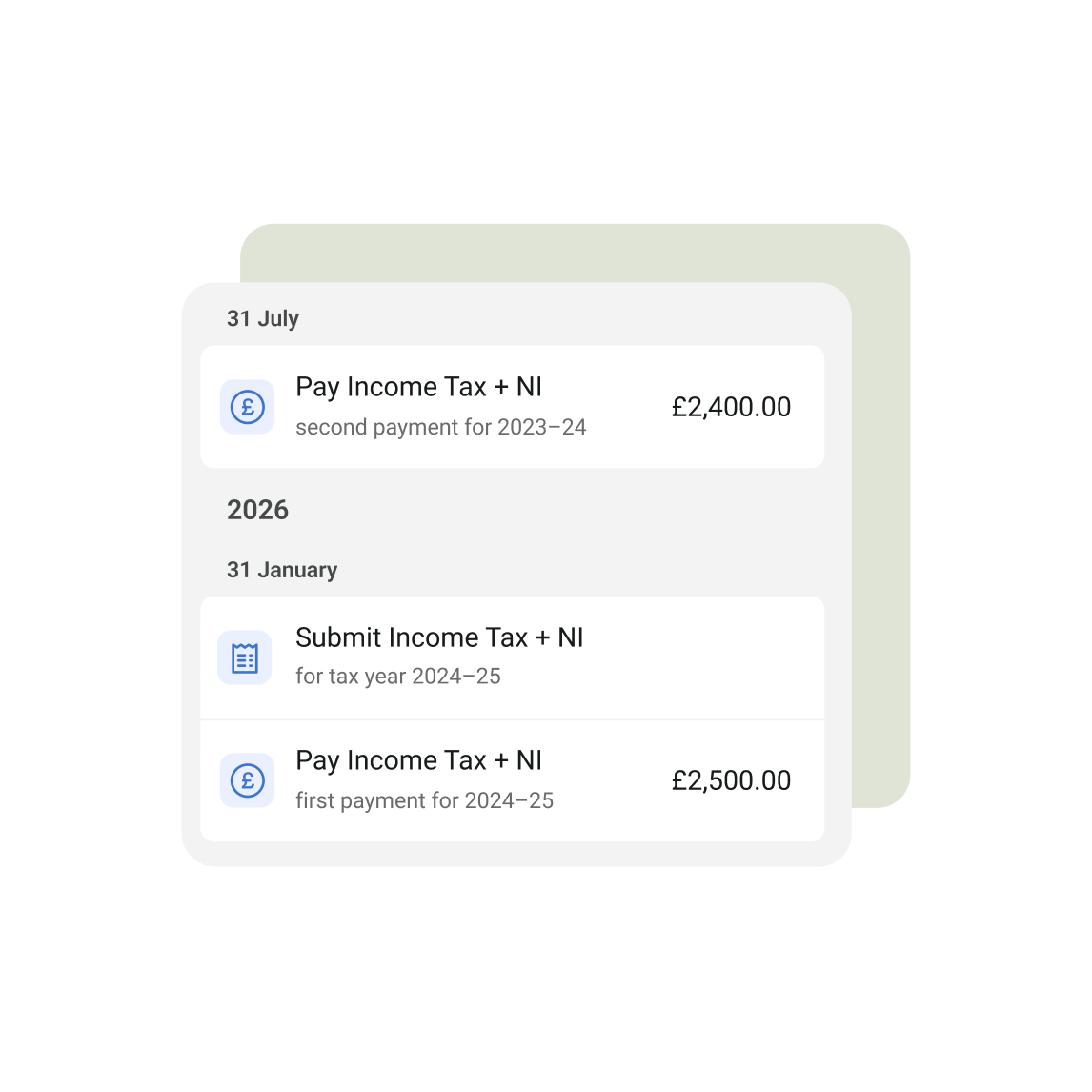

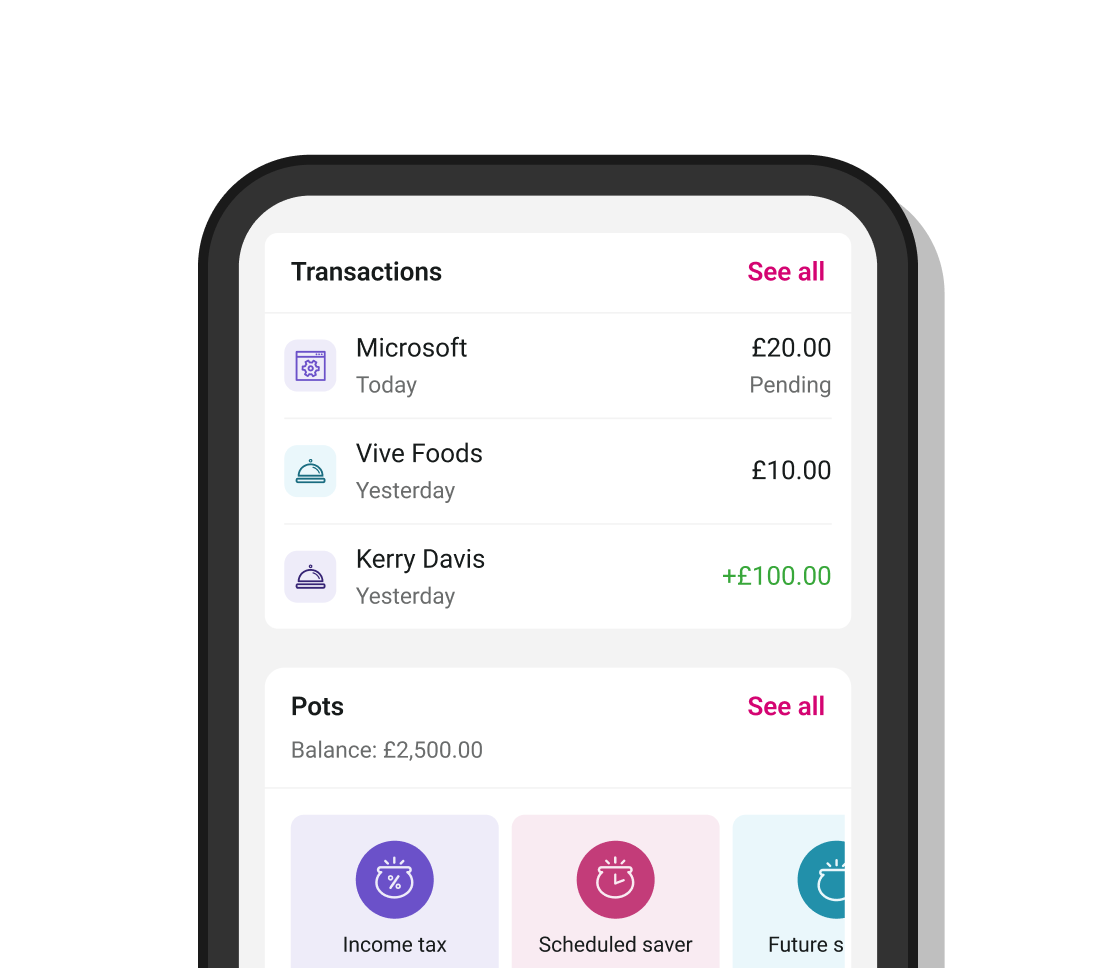

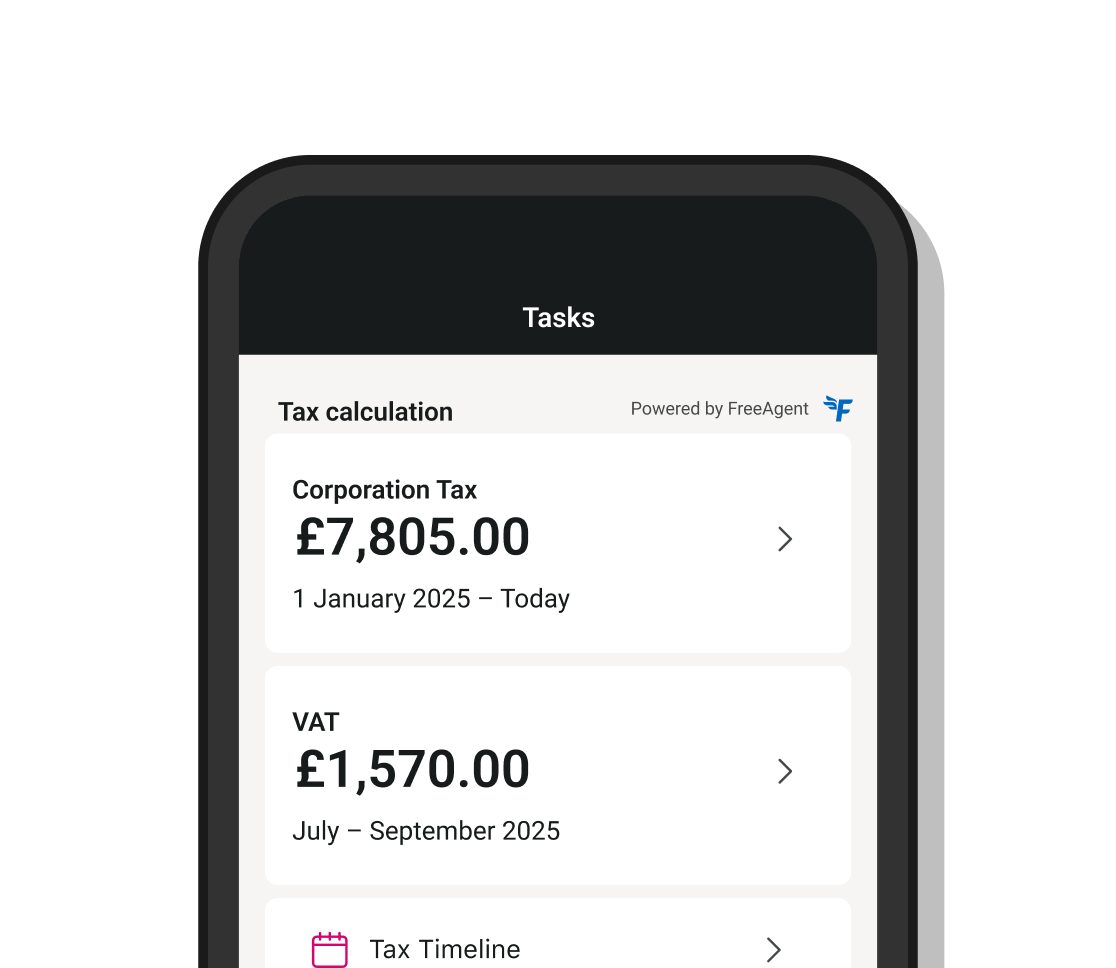

Keep track of crucial tax deadlines and requirements. The tax timeline feature in the Mettle app, powered by FreeAgent, helps you stay organised and prepared. See a running total of how much you’re likely to owe with the tax calculation too**.

*To get FreeAgent for free, you must make at least one transaction a month from your Mettle account. If you don’t make one transaction a month, or if your Mettle account is closed and you continue to use FreeAgent then the FreeAgent fees will apply. **You will need to be connected to FreeAgent for the tax calculation and tax timeline feature to be accurate. FreeAgent has optional paid-for add ons that may be chargeable.

MTD signup checklist: 5 steps to get ready before the deadline

The role of the accountant in Making Tax Digital for Income Tax

What is Making Tax Digital and how will it impact you?

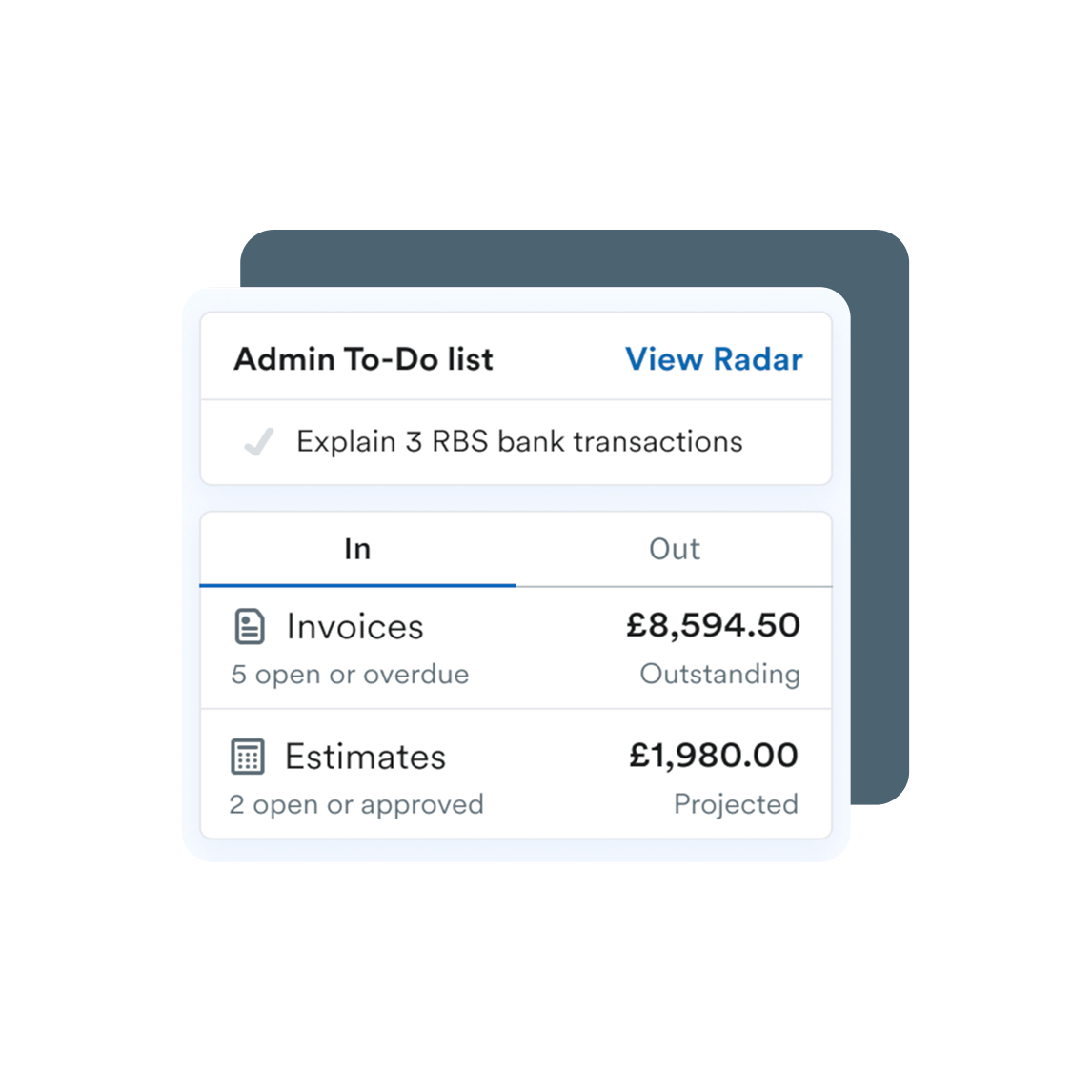

Mettle helps you keep all your business transactions in one place, neatly organised and easily searchable. This eliminates the stress of gathering paperwork when it's time to submit your tax updates.

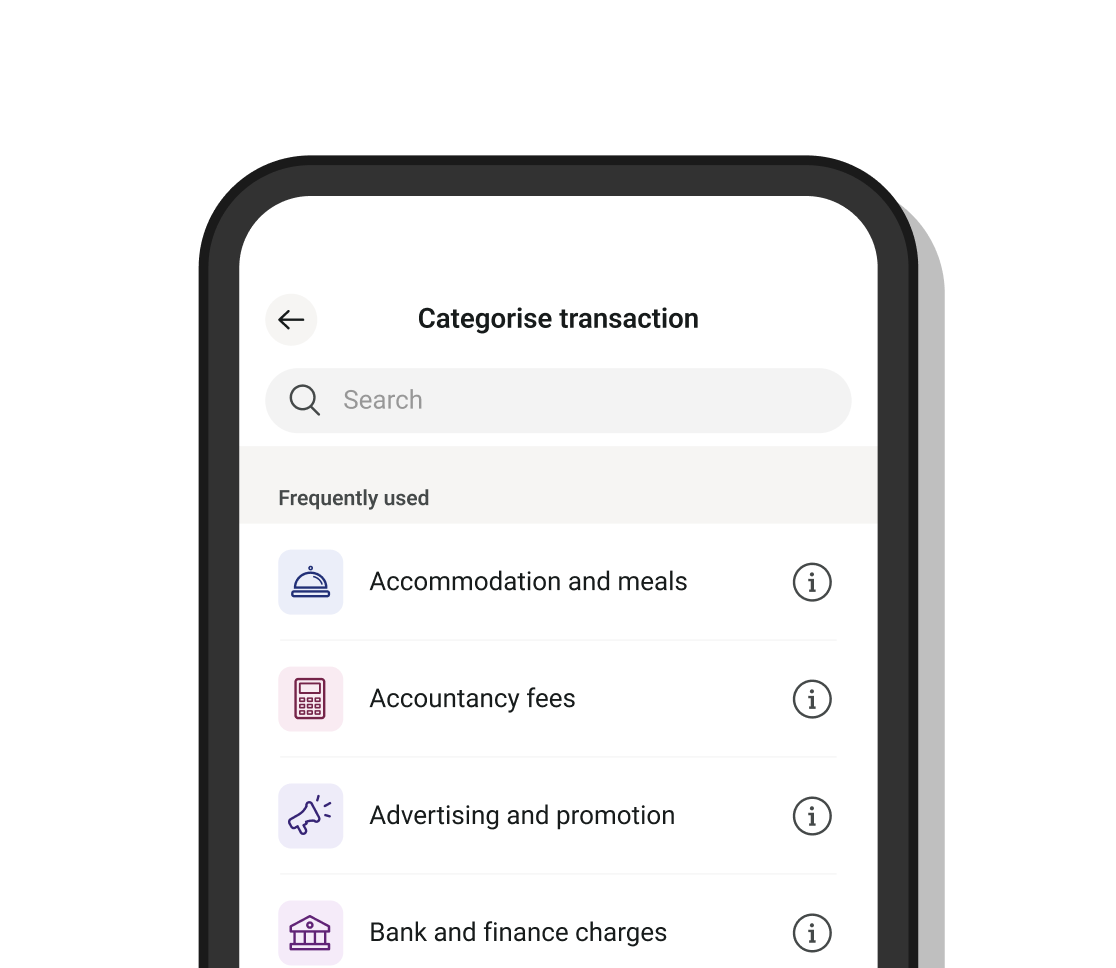

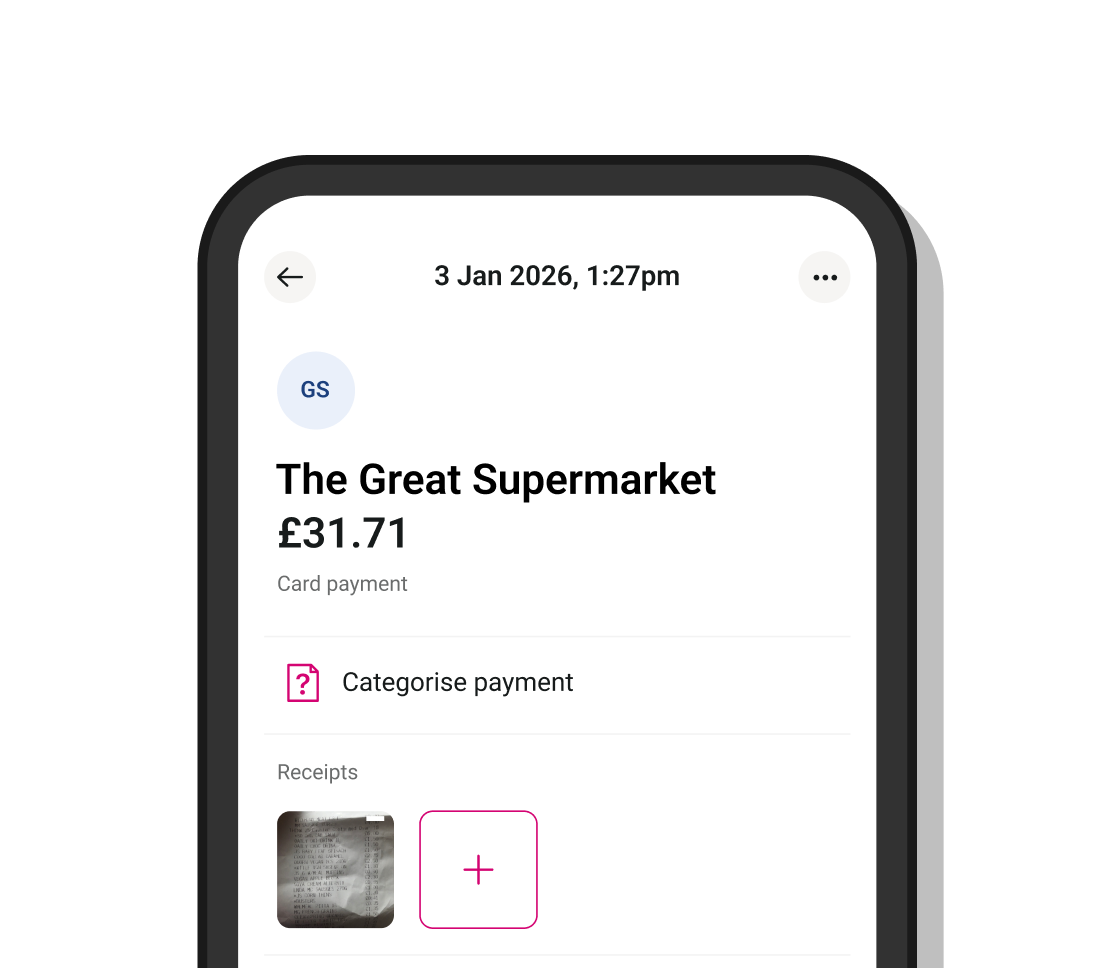

Mettle automatically categorises your income and expenses, saving you valuable time and ensuring accuracy. This feature simplifies your record-keeping and provides a clear overview of your financial position for tax purposes.

Say goodbye to shoeboxes full of receipts. Mettle allows you to easily photograph and store your receipts digitally within the app, ensuring you have a secure and organised record of your expenses.

Use the tax calculation feature to see how much tax you’re likely to owe at the end of the tax year. By connecting to FreeAgent, you can get a running total in the Mettle app, along with a tax timeline.

Discover the tax calculation feature.

Have a quick look at our eligibility criteria.

Making Tax Digital (MTD) is HMRC's initiative to modernise the tax system. It requires businesses and self-employed individuals to maintain digital records of their income and expenses and submit updates to HMRC through MTD-compatible software. This aims to reduce errors, improve efficiency, and simplify tax administration.

If your business or property income is below £50,000 in the 2026/27 tax year, you will not be mandated to use MTD for Income Tax. However, it's worth preparing early as the threshold will be lowered to £30,000 from April 2027. Keeping digital records can also bring benefits to your business, regardless of the mandate.

You don't need to register separately for MTD. Once you start using MTD-compatible software to submit your income tax updates, you are effectively participating in the system. You will, of course, need to be registered for Self Assessment with HMRC.

To comply with MTD for Income Tax, you'll need to use MTD-compatible software to keep your digital records and submit your quarterly updates to HMRC.

Read moreThis software can take various forms, including:

Accounting software packages (like FreeAgent, Xero, QuickBooks)

Spreadsheets (with HMRC-approved bridging software to connect to HMRC's systems)

Mobile apps designed for record-keeping and MTD submissions

You can find all MTD-compliant software on the HMRC website here.

You’ll need to submit quarterly updates to HMRC as part of MTD. While the exact dates can be subject to change, it’s best to check the HMRC website for the latest updates and information.