If you're on top of your taxes and build it into your financial structure, you'll be left with a better understanding of what you earn now and what you can earn in the future.

Here are a few things to look out for.

Defining where you're at

It’s important to first define at what stage the business is at, whether it's something that's grown from a side hustle into a full-time gig or it's a fully fledged, established business that's been around for years.

If you're at the beginning of your journey and evolved from a side hustler using platforms such as Depop, Vinted or eBay are a bit of a grey area. Someone selling their old jumper shouldn’t be taxed on what they make from that, but those who use them to sell their own products or with the intention to generate continuous profit from it would be classified as ‘trading’. These people should register as self-employed and include that income when it comes time for tax self-assessments.

A clear definition of this is if your total trading income is less than £1,000 in a tax year - 6 April to 5 April - then you do not need to worry about paying tax or registering as self-employed.

This is a total and not specific to a single business, this doesn’t mean you can generate £950 from selling candles, £999 from freelancing and so forth. Instead, it means you could for example earn:

£680 from selling candles

£100 from that one time you let your room out on Airbnb

£200 from the occasional Deliveroo journey across the tax year

Total = £980, meaning you don’t need to worry about taxes on these ventures.

On the other hand if your small business is generating more than £1,000 then you need to register as self-employed on the HMRC website, which is easy and simple to do. It is good practice to do this as soon as you realise in order to avoid any fees or penalties later down the line, but the strict deadline for registering as self-employed is the 5 October after the tax year you launch in. For example, if you started your side hustle business on 25 June 2020 the deadline for registering is 5 October 2021.

Calculating your tax

You’ve got this far, you’ve registered as self-employed. You’re running your small business in the anticipation of earning more than £1,000 alongside another job and you want to be sure that by the time it hits 31 January 2022 you have proactively filled in the tax self-assessment. One way to prepare is by using the HMRC calculator to work out how much tax you could owe.

Once you’ve worked out roughly how much tax you will owe you can start saving for it by setting money aside. You can do this by moving it into a separate account, using a pots tool, if your account has the functionality, or even by going old school and popping your cash into a classic piggy bank.

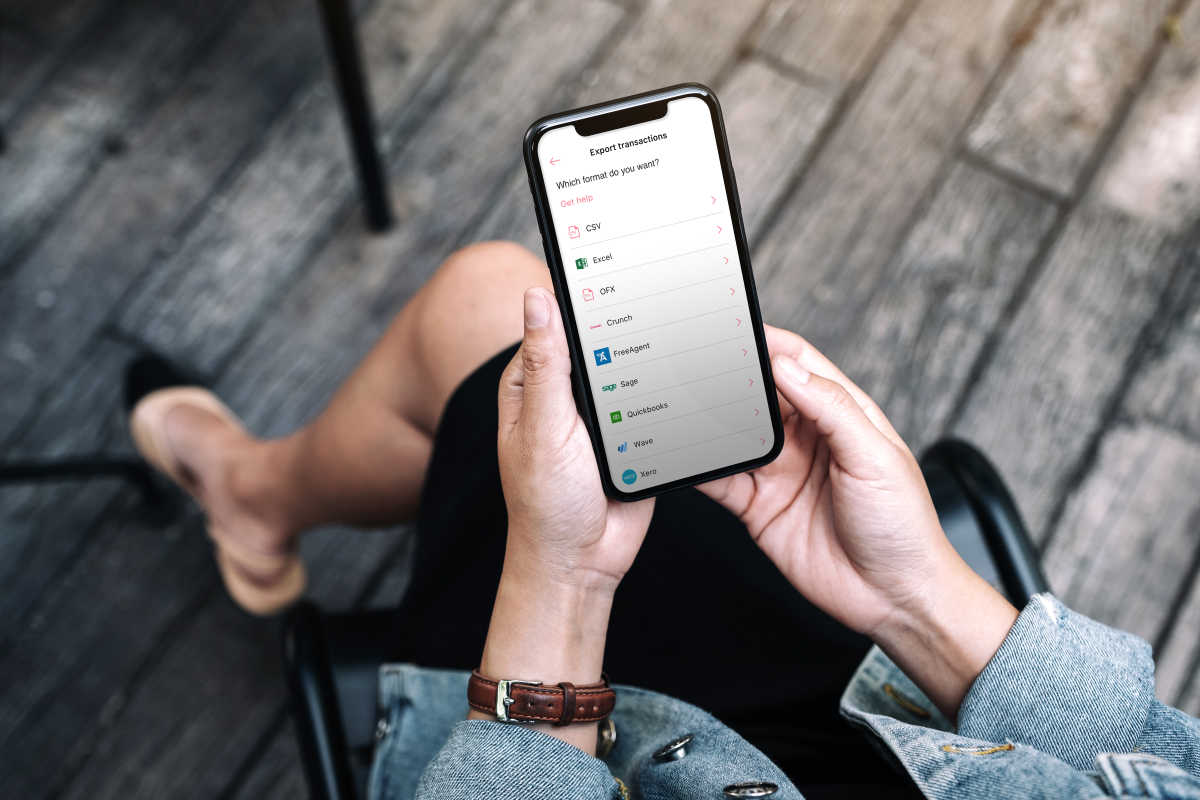

As a sole trader it isn’t compulsory to open a business account, this is because HMRC view your personal and business income as one and the same. However, a limited company registered on Companies House must have a business account as it is viewed as legally separate. As a sole trader a business account is still a key tool that helps keep everything in one place and can come with added benefits, see why you might need a business account.

A term worth defining at this stage is payments on account, this is what might make your tax bill larger than expected. Essentially payments on account is your tax bill paid a year in advance. For any given year if your tax bill, the amount due to HMRC, is more than £1,000 they will ask you to make a ‘payment on account’.

Two exclusions for payments on account:

Tax bill is less than £1,000

More than 80% of the tax you owe has already been paid

If we take a few examples,

James sells software and when it comes to paying taxes his bill for 2019/20 is £680 so he doesn’t need to make any payments on account, he simply has to make sure £680 is paid by 31 January 2021.

Susan sells jewellery on Instagram and has a tax bill of £2,100 for 2019/20. As her bill is more than £1,000 when it comes to 31 January 2021 the amount due will be £3,150.

This is made up of the £2,100 tax bill for 2019/20 and a £1,050 bill consisting of half of next years tax 'paid on account' = £3,150.

She will then have to pay a second payment on account of £1,050, being the remaining half of 2020/21 tax bill, by 31 July 2021. This is due to HMRC assuming the tax bill will remain the same year on year.

For Susan when it comes to the next tax deadline, here 31 January 2022. Depending on her earnings between 6 April 2020 to 5 April 2021 she may have a further outstanding tax amount to pay on top of the payments on account already made.

This additional amount is known as a ‘balancing payment’. It could also be found that she has overpaid her tax bill in which case she will receive a tax rebate - a refund of tax from the government.

It is worth pointing out that if you find yourself in a position where you know your tax bill is going to be lower than last year you can get in touch with HMRC to ask them to reduce payments on account.

Top three tax tips:

Keep information for 7 years, the strict rule for self-employed individuals is 5 years after the 31 January when the return was due but best practice is 7 years to allow for any need of evidence should HMRC request it

Business expenses can be deducted from your income, reducing your taxable amount, HMRC provide clear guidelines for what this counts as here

Once registered as self-employed you will remain that way, until you tell HMRC otherwise. If you ever decide to put your side hustle to one side then you must let HMRC know or else you will continue to get taxed as if you were still operational

If all of this still seems daunting there are plenty of resources online HMRC has the most detailed and up to date information but there's also Money Saving Expert or other blogs on the Mettle website to help keep your taxes on track.

Interested in finding out more about Mettle? Check out our eligibility page.