Gone are the days of visiting a bank branch between the hours of 9-5 Monday to Friday to open a business account. The same can be said of asking those same businesses to hand over numerous documents and pieces of information to prove every detail of their business.

Advances in technology have saved us time in almost every aspect of our day-to-day lives, so when we started to think about how customers would open a Mettle account, our motivation was to build the simplest process we could.

After all, why should opening a business account continue to be such a manual, time-consuming process?

Our ultimate goal is to help new customers onboard in the shortest time possible and to see value from using Mettle straight away. By focusing on a combination of thoughtful design and the latest technology, we’ve been able to provide a smooth account opening process that saves our customer’s time.

Types of IDs you can use

It also means that we can better manage the risk of fraud and other types of financial crime while meeting standards set by key regulators.

Why we have to do this

Effectively managing the risk of fraud and financial crime while making sure we’re compliant with regulations is a core part of our onboarding process. Although not the most exciting of topics, all banks or financial institutions in the UK have to complete ‘Customer Due Diligence’ (CDD) when onboarding new customers, helping to identify and verify them and their business.

This is an important part of keeping customers and the money they trust us with safe.

Ultimately, it falls on us, banks and financial services companies to prevent these types of crimes from happening.

How we do our best to make sure this doesn’t happen to you

When you apply for an account, we ask a few questions about your business and the industry you operate in. This helps us to get to know you better and see if you and your company are the right fit for a Mettle account.

We also ask about any beneficial owners of the company, one of which will be a ‘person of significant control’. We ask for a few personal details and photo ID, coupled with a short in-app video where we use biometric technology to make sure it’s really you – not someone trying to open an account in your name.

Face verification screen

This is one example where we are taking a manual process and building it into a digital experience. It’s still the case that to open a high-street bank account you need to physically visit a branch for a member of staff to manually compare your face to the photo in your ID document, something we have been able to eliminate through the use of new technology.

The combination of a few business and personal details is usually all we need to open your account in a few hours, often in a few minutes.

Where we’re headed with emerging technologies

The challenge we constantly face is to provide a fast, digital-only account opening experience that’s also personalised and enjoyable.

While it seems pretty straightforward, transforming a traditionally human-based process into something that is purely software based presents a number of challenges.

Humans can evaluate a situation and make a judgement in real time where software doesn’t typically work well with ambiguity. Coding for any number of judgements that a human working in a bank branch can instinctively make can be challenging, particularly when it comes to customers with more complicated circumstances. Unlike traditional banks, where kinks in the process can be smoothed over by a real human being – software isn’t so forgiving.

Support from real people when you need it

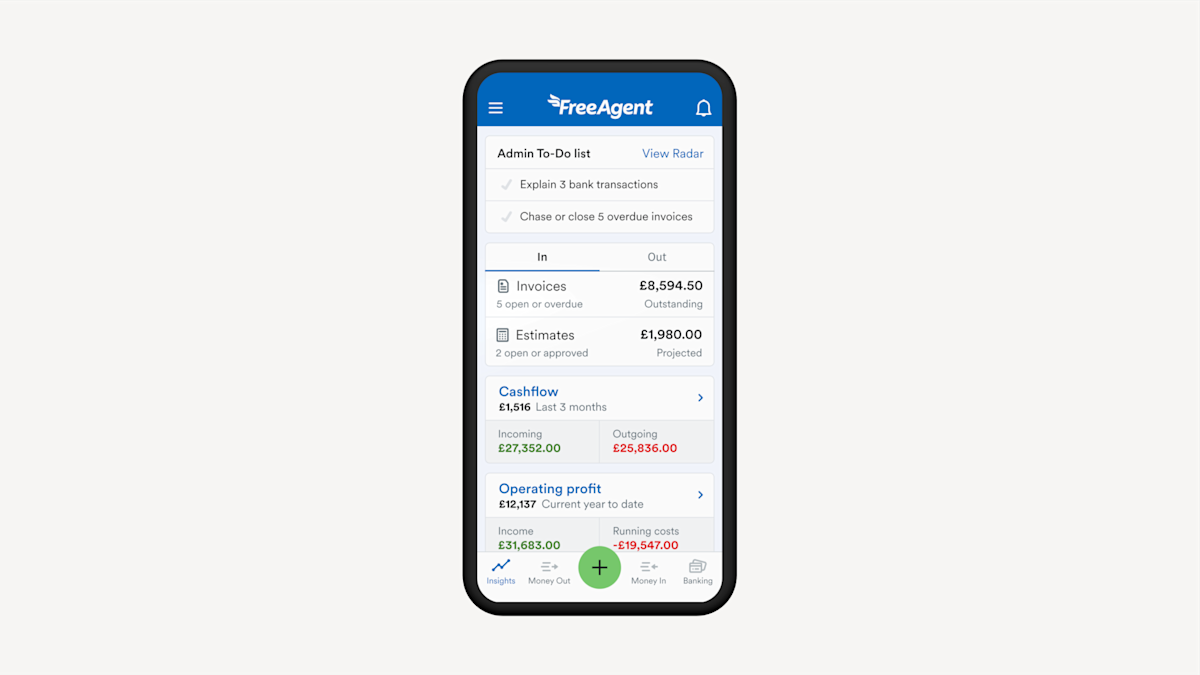

Access key account information on one screen

But we’re refining our process all the time and reacting to customer feedback is a big focus for us. For the scenarios that we haven’t thought of yet, we have a dedicated support team, so human help is always on-hand for when we haven’t quite got the formula right.

Interested in learning more? Check out Mettle's business bank account features.