Whether you’re only just starting out or you've been running your business for years, it's never too late to start budgeting.

So, you're good at what you do, you love working for yourself and you know you can make it work. Ready to make a plan for the year ahead? It's a straightforward thing to do in principle but not something that is always obvious to prioritise (especially when starting out).

Budgeting is all about forecasting your overall sales, expenses and therefore profits. When you set it, it feels like guesswork, but it’s a starting point. It’s part of you setting your goals and objectives and it’s part of the plan of action to achieve your goals.

Here's your 5-steps to follow...

1. Look at what sales income you’ll need and think about how you will achieve it. What's your sales and marketing strategy? Do you need help with it? Do you need to invest in order to generate sales leads or can you get them organically? Do you have the time to do this?

I set up my business whilst I was on maternity leave. I told friends and family, and anyone who would listen, what I was doing and some work came from them and from referrals. I joined some amazing Facebook groups and communities online and work came from relationships I built there too. I'm active on social media and I attend quite a few informal networking groups. All these things help with just getting your business name out there.

2. Now look at your business overheads (expenses). What do you need to spend money on so that you can operate your business?

Budgeting for the income side is fairly straightforward, but looking at your business expenses is just as important. I like to look at them in 3 groupings:

Essentials or fixed costs

Nice to haves or variable costs

Investments in yourself and your business

Essentials will be different for everyone, depending on your business and your own skillset. For example, not everyone will need an accountant as a sole trader. It's possible to do your own self-assessment if you feel confident, but some people just prefer to delegate or outsource this so that they can concentrate on their business and save them time and stress.

Nice-to-haves, things that you can arguably do without. Look at those subscriptions, do you need them all? Are your paid networking groups and advertising converting into sales or are they just costs that you can cut?

Invest in yourself and your business. Courses, training and coaching are all investments that can really boost your income long term. They help with confidence and mindset but you might have to think about how they affect your bottom line when you set your budget.

3. I know lots of people budget for the calendar year but I suggest budgeting for April to March if you are a sole trader or for your own financial year if you are a limited company. Write it all down. Then get it into a spreadsheet.

4. Tracking against your budget. Check in every month or every quarter to see how you are doing against your budget. Are you on track? If not, where do you need to make changes? Do you need more sales? How will you get them? Can you cut back on spending?

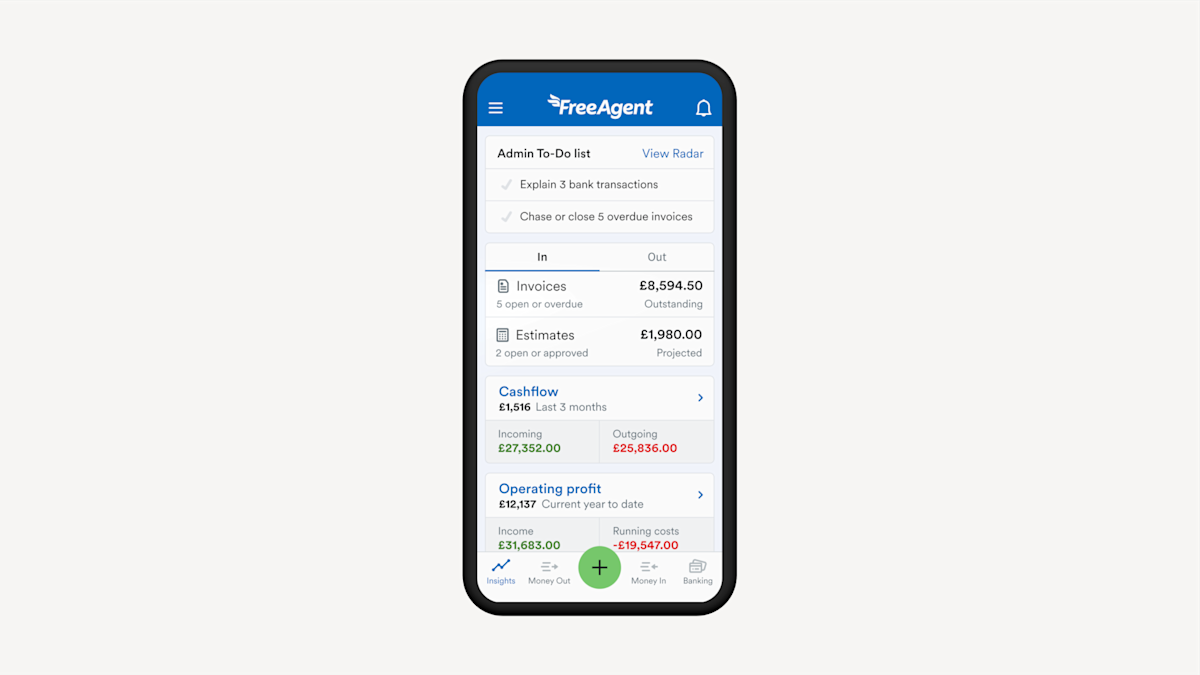

The best and easiest way to keep on top of your finances is by using accounting software. There are lots of options, but my preferred software for service-based businesses is FreeAgent. And, did you know that if you sign up for a free Mettle account, you get a free FreeAgent licence and can save yourself more than £150 a year*, based on FreeAgent’s lowest tariff.

5. Repeat the process annually and learn from past years, successes, mistakes... what is working and what isn't.

At the start of your year, look at last years’ budget. Have a look at how you did against your target and think about adjustments you made throughout that year. Think about how often you tracked against your budget. Can any improvements be made? Try to set yourself goals to continually improve your budgeting.

So, now there's no excuse, get your budget in place for 2021/22.

Interested in finding out more about Mettle? Check out our eligibility page or discover the features of a Mettle business bank account.