If you drive a vehicle for your business, you can claim tax relief on your mileage expenses from HMRC. But, be aware that this doesn’t include travelling to and from work, unless you’re travelling to a temporary place of work.

The types of trips that are eligible are:

Travelling to a temporary place of work (like if you’re a builder and are travelling to a site)

Travelling to a meeting that is outside your normal place of work

Travelling to a location to buy equipment for your job (this doesn’t include if you stop off to do personal errands)

Always keep a record of your mileage

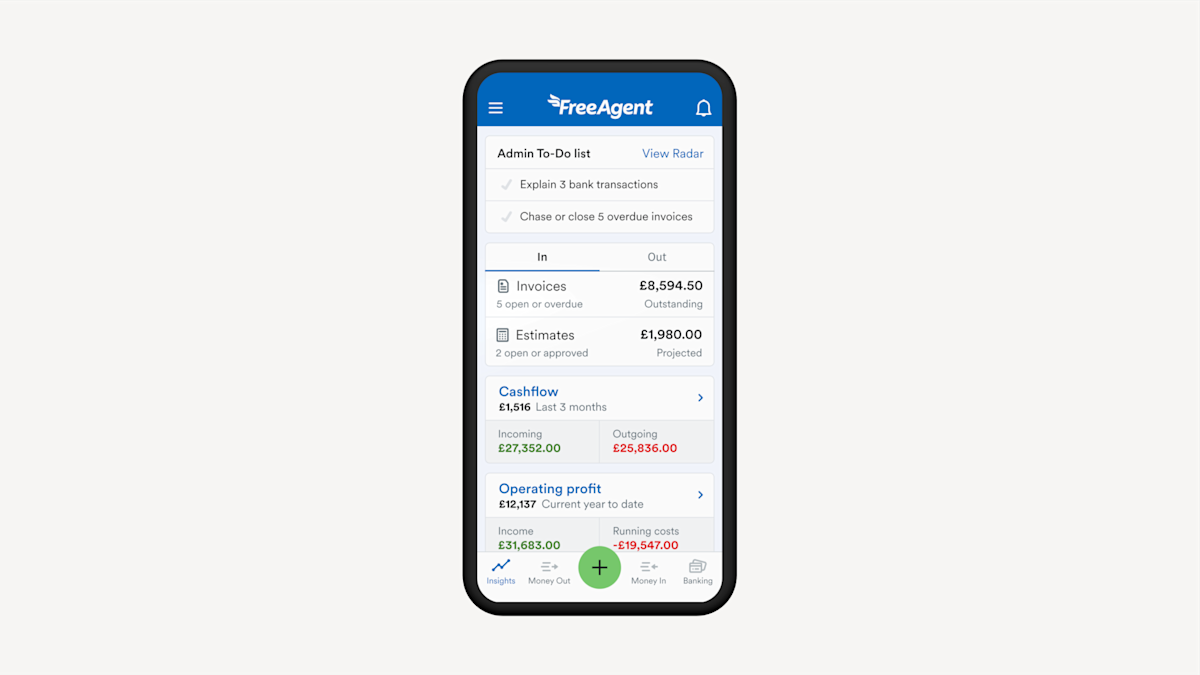

You’ll need to keep a record of the number of miles you travel and on which dates throughout the tax year. You only need to account for miles you’ve travelled for business (HMRC calls these ‘business miles’). You can easily do this on accounting software like FreeAgent.

If you also usually claim for other things like fuel or general car expenses, you’ll need to keep receipts as evidence of your spending and keep track of these over the year.

How much can you claim?

The amount you can claim for is different depending on the type of vehicle you use, and the number of miles you travel for business. If you use the vehicle for personal errands or trips, you’ll need to keep records of how many miles are specifically for business use. Once you know that, you can claim mileage for cars, vans, motorcycles and even bicycles. For cars and vans, the amount you can claim is reduced after the first 10,000 business miles.

The amount you can claim for mileage hasn’t changed since the 2011/12 tax year, and no changes have been announced ahead of the 2023/24 tax year.

Any changes to the mileage allowance would be announced well before the new tax year starts, so you can plan accordingly.

The current mileage rates for 2023/24 are:

Table showing mileage rates for 2023/24.

If you travel with someone else who works for your business, like a business partner, you can also claim a further 5p per business mile when they are travelling with you in a car or van.

How to claim business mileage

The way you claim for this expense depends on how you’re employed.

You can claim back mileage as part of your Self Assessment tax return if you’re self-employed or otherwise usually complete a tax return in this way. Keeping a record of your mileage throughout the tax year will mean this part of the process is quick and easy to do when you get around to it.

If this is your first time completing a Self Assessment tax return, read our guide to nailing your tax return before you get going.

If you work for an employer, they will sometimes pay you an allowance for your mileage, which you’ll claim back directly from them. If there’s an amount left over, you can claim the rest directly from HMRC either online or using a P87 form.

Check if you’re eligible to claim for mileage, and the best way to do this for your circumstances, at gov.uk.

Disclaimer: The content of this blog is based on our understanding of the topic at the time of publication and should not be taken as professional advice. Any of the information may be subject to change. You are responsible for complying with tax law and if in doubt, should seek independent advice.