Let’s start with the basics…

Introduction to bookkeeping

Years ago, a bookkeeper would keep a record of all business transactions in books and ledgers – hence the name. Now, there’s some fantastic software, like FreeAgent, and online banking options, like Mettle, that make bookkeeping straightforward.

With a Mettle business bank account, you can categorise your transactions, auto-match your receipts to payments and easily download all that information to share with your accountant. You also get FreeAgent accounting software for free saving you up to £150 a year.*

Here are just a few ways good bookkeeping can help your business:

Keep track of daily transactions coming in and out of your bank

Send sales invoices to customers and chase overdue invoices

Handle bills and make sure that they’re paid on time and recorded

Keep an eye on cash flow

Prepare the books for an accountant to review

Bookkeeping for small businesses

For small businesses, bookkeeping and accounting differs to larger businesses in that they might not have a formal system set up yet. And so, it’s super important for your small business to get these basics in place, especially when it comes to keeping track of your expenses and profits and having everything in order for your tax returns. The main reasons why you need to keep your records up to date:

You’ll know straight away if you’re making a profit (ie if you’re making more money than you’re spending)

Keep track of who owes you what and when they should pay

Know who to chase for money and when. Being proactive in keeping the cash coming in is key to keeping your business afloat

Be more aware of upcoming bills from suppliers

You’ll be ready to prepare your tax returns far in advance of any deadlines, and know how much to keep to one side

Using professional accounting practices, or software to help meet your bookkeeping needs can help give you time back to focus on your business.

Bookkeeping tips for small businesses

Bookkeeping might not be the most glamorous part of running your business, but it’s important. When it comes to bookkeeping, here are some tips on what you should do:

Keep a file for each trading year or tax year and divide that file into these categories:

Sales invoices

Receipts

Bank statements

Tax documents

Keep a record of all your invoices (see HMRC guidance on what to include here)

Keep a record of all your expenses and costs – this includes keeping receipts. Digital is the best option here

Check your bank balance regularly and make sure you’re ready for any large bills

Make sure you keep track of who still owes you

Have a separate bank account for your business. Things can get incredibly muddled if there are lots of personal transactions going in and out

But, just as important, there are also some things you should try and avoid when it comes to bookkeeping. So don’t:

Keep a shoebox full of receipts. This will stop you feeling in control and you might quickly lose track of how much you’re spending

Put off paying bills to suppliers, your taxes, your employees. Paying anything late can have a big impact on those relationships, and can affect your credit score too

Put off the bookkeeping. Little and often is much easier than doing a whole year in one go

Use your business bank account for personal shopping, booking holidays, paying back friends etc.

You’re forming a habit, and this can take time. You might miss a week or a month – and that’s ok. But do try and get back to regularly keeping on top of the books.

There’s plenty more help available on Dead Simple Accounting’s website.

What is the best bookkeeping software?

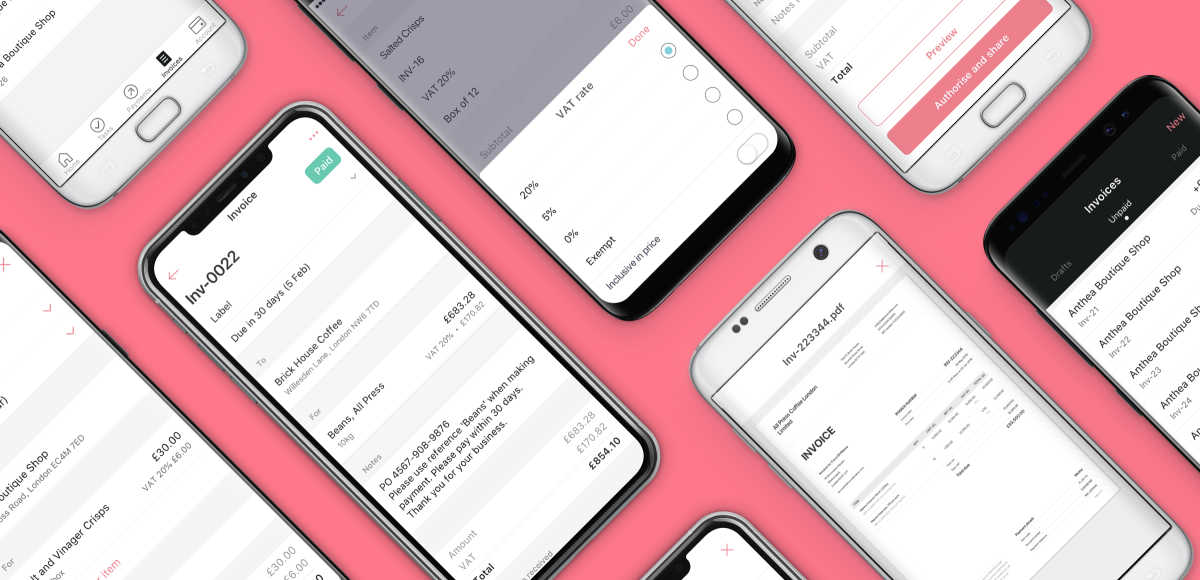

With a Mettle account you get FreeAgent’s award winning accounting software for free, saving you up to £150 a year. All you have to do is make at least one transaction a month from your Mettle account.

With Mettle you can also easily connect to Xero. It’s an entirely digital process so getting your bank feed set up is easy – with no paper forms:

Open your Mettle app (make sure you're on the latest version)

Tap ‘Connections’ on your Account screen

Select Xero

Agree to sharing your data

Confirm if you've manually uploaded Mettle transactions to your Xero account previously. If you have done this we will only send transactions from the date of connection

You’ll be directed to Xero and asked to log in to your account

Once your transactions are cleared, we’ll share them. Some of these will appear instantly, but if they’re still pending it can take two or three days to show.

A lot of Dead Simple Accounting’s clients use Xero, Quickbooks or FreeAgent – all three are great and pretty cheap too.

In fact, you can start a free trial with any of them and see which one you like best before committing. There are plenty of other options that are free too.

What’s the difference between a bookkeeper and an accountant?

Bookkeepers keep track of day-to-day transactions. Whereas accountants can help you see the bigger picture. For example, profitability, where the business should be in 12 months, and give accurate tax estimates.

But keep in mind that experienced bookkeepers and accountants can provide other services as well, like preparing helpful financial reports

A Profit and Loss statement (which itemises all the ins and outs of your business)

A Balance sheet (which gives you a snapshot of how much the business owns, is owed and owes other people)

A cash flow report (which shows where the cash that comes in, ends up)

As your business grows, you might find value in getting an accountant to help with more demanding tasks like running payroll, preparing VAT returns, and filing tax returns.

After all, if it’s not your strong point, or if you put off these important bits, it’s better that you get the right professional help and support.

How to hire and work effectively with an accountant

A surefire way to keep your accountant happy is to keep a separate record of your personal and business transactions and ideally have a digital record of all your business receipts and invoices. That way they can collaborate more easily.

When your bookkeeping is up-to-date, your accountant can also give you helpful and proactive advice. Rather than sorting through items that don’t reconcile, they can help you plan for the future, advise on ways to save money and reduce costs – and find ways to reduce the dreaded tax bill.

This blog was updated on 25 September 2023

*Based on FreeAgent’s lowest tariff. To get FreeAgent included, all you have to do is make at least one transaction a month from your Mettle account. If you don’t make one transaction a month, or if your Mettle account is closed and you continue to use FreeAgent then the FreeAgent fees will apply.

The content of this blog is based on our understanding of the topic at the time of publication and should not be taken as professional advice. Any of the information may be subject to change. You are responsible for complying with tax law and if in doubt, should seek independent advice.

Frequently asked questions

Can I do the bookkeeping myself?

Yes you can. It’s honestly not too time-consuming if you’re disciplined and you do it regularly. You can also use your Mettle account to help categorise your transactions, upload receipts to payments and see your invoices. All this information can be downloaded and shared with your accountant. It’ll also auto-sync to your FreeAgent, Xero or Quickbooks accounts.

Who is Dead Simple Accounting?

We’re expert accountants for small businesses, freelancers, contractors and digital nomads. Rated 5 stars on Google, Facebook, Quickbooks and Xero. Rated top 3 Accountants and top3 tax service in Reading. Winner of SME News “Most Outstanding Accountancy Firm” and “Client Service Excellence”. We’re ready with Making Tax Digital and our fees are all listed on our website.

Read more