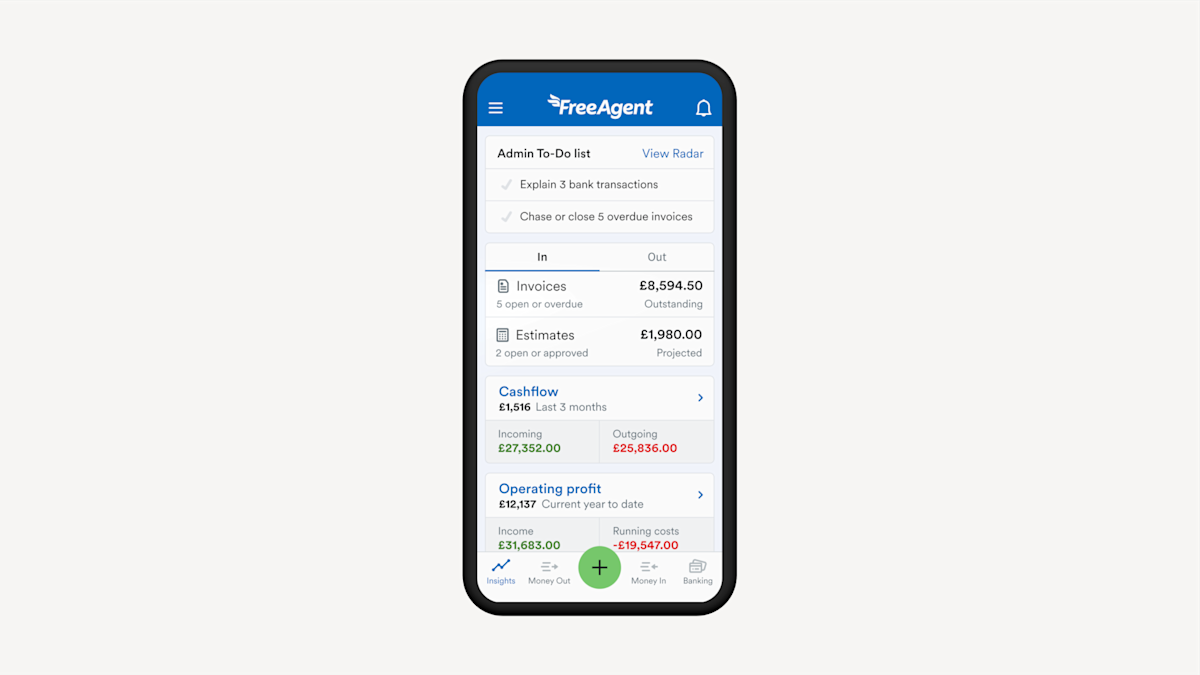

When you’re starting out as a sole trader or a limited company it’s a good idea to set up a separate business account. Having a separate account not only helps you keep track of your business finances, but it also means you can keep track of cash flow, invoices, and connect to accounting software, like FreeAgent.

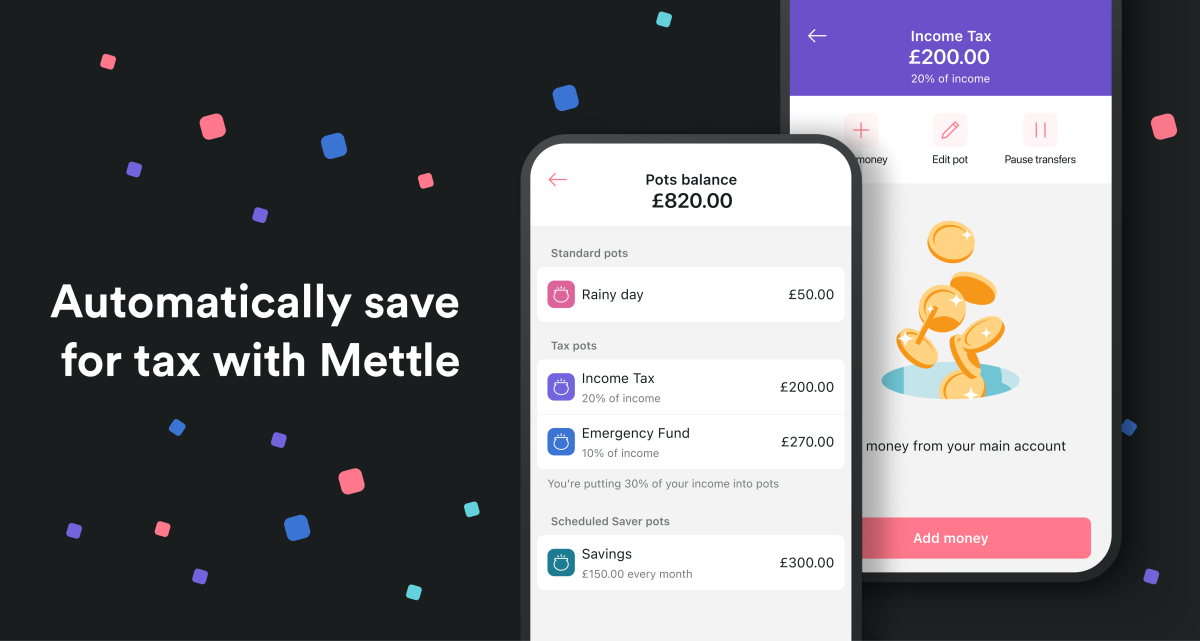

It also means you get great features like Money Pots, where you can set aside money for your tax return, or general savings for your business.

‘Having separate pots for my money is great, but how can I put money aside without thinking about it?’ we hear you say. And we have the solution.

New rules for your money pots

Since launching money pots back in 2020, we’ve been busy thinking of ways to make them more useful. When we spoke to you, you gave us some great feedback on how we can improve them

You liked that Pots gave you an overview of your financial positions, and even though it’s great they are ‘separate’ from your main account, you don’t want the money to be ‘off limits’. You also told us that you want to use smart rules mainly for tax, VAT, personal tax, and National Insurance.

So we’ve done just that!

To help make it easier for you to save for the things you need, we’ve introduced different rules. This means you can save in a way that’s best for you.

You can either:

Set up a transfer rule to save a specific percentage of each incoming transaction, or

Start a regular payment into a pot for any amount, as often as you need

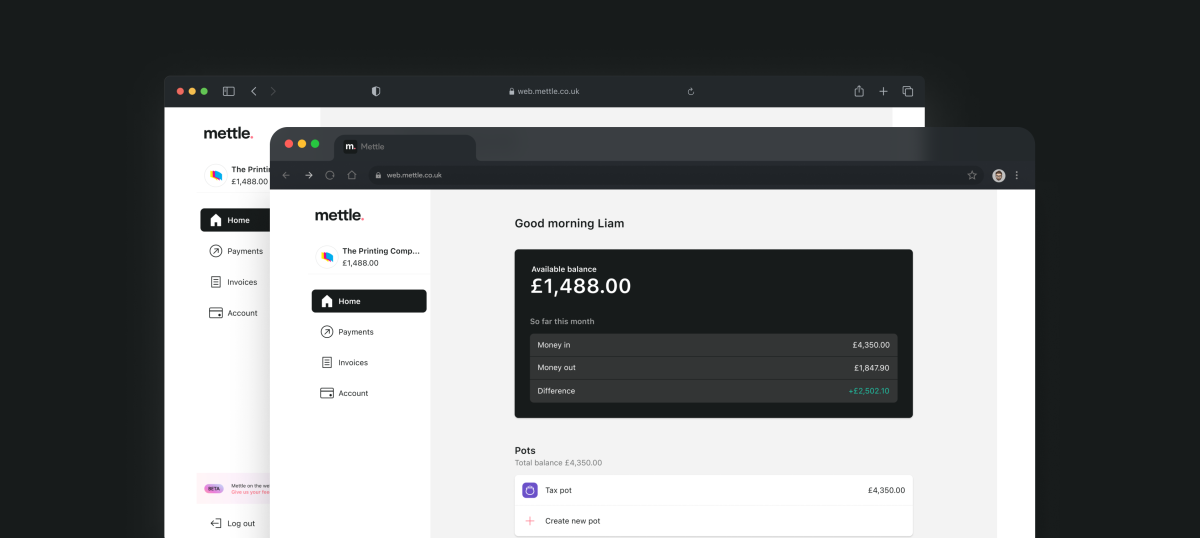

How to set up a transfer rule for your pot

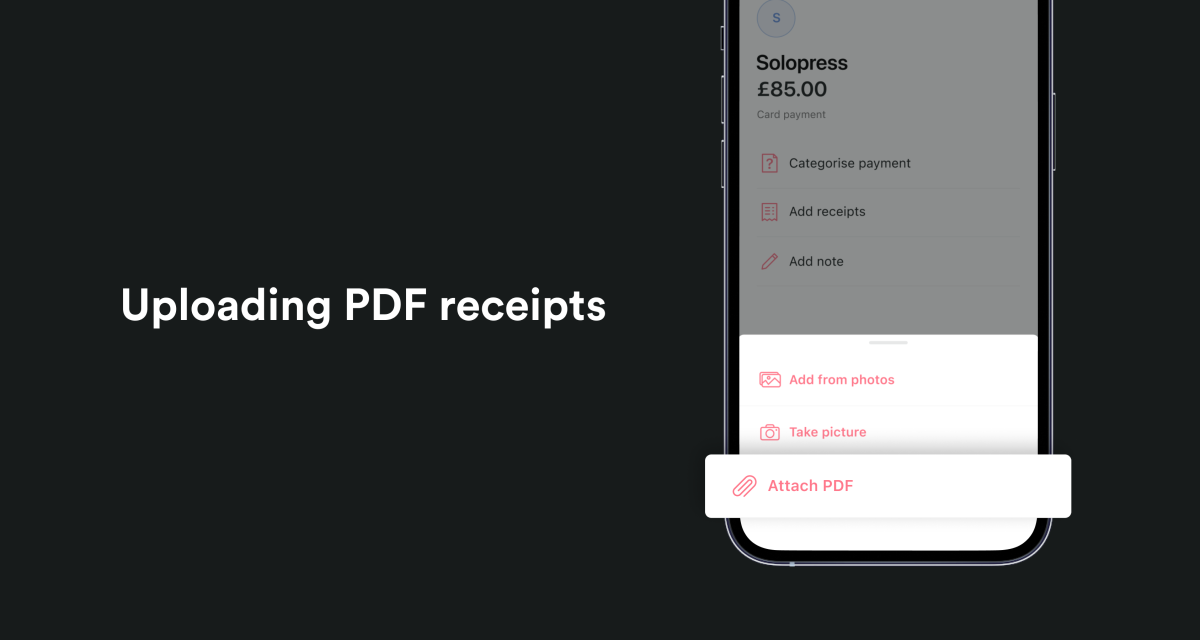

Log in to Mettle via the app or on the web, and select ‘Pots’

Choose to set up a Tax pot, Scheduled Saver or a Standard pot

Name your new pot and personalise the colour

How it works

If you want a Tax pot:

Choose a percentage of each incoming transaction you’d like to be automatically transferred into your pot.

If you want a Scheduled Saver:

Choose how much you’d like to transfer, how frequently, and for how long.

You can also set up a new transfer rule to one of your standard pots:

Just head to your pot and select ‘Add transfer rule’. You can choose to change your pot to a tax pot or a scheduled saver.

How much money to put aside for your tax bill

First things first, when it comes to getting tax ready, make sure you’ve registered as self-employed. Once you’ve done that, to find out how much tax you’re likely to pay, the government website has a handy calculator. You can also find out more information on MoneyHelper, a government organisation that offers advice and help around everything money-related.

If you’re self-employed, you’re still entitled to the same tax-free Personal Allowance – the amount of money you can earn before you start paying Income Tax – as someone who’s employed. This means, for the 2022-23 tax year, the standard Personal Allowance is £12,570.

This changes if you own over £100,000. Then the standard Personal Allowance of £12,570 is reduced by £1 for every £2 of income you earn over the £100,000 limit for the 2022-23 tax year.

Paying National Insurance when self-employed

Don’t forget about National Insurance payments.

Even though you’re self-employed, you still need to pay National Insurance. According to MoneyHelper, most self-employed people pay Class 2 NICs if their profits are at least £6,515 during the 2021–22 tax year. Or £6,725 in the 2022-23 tax year.

If you’re over this limit, you’ll pay £3.05 a week, or £158.60 a year for 2021–22 (£3.15 a week or £163.80 a year for 2022-23).

Note, if your profits are below the Small Profits Threshold, then paying Class 2 contributions are voluntary.

Now that you know what you need to pay, and have a smart way to separate out your cash, you’re ready to set up some rules for your money. Then sit back and relax knowing that your pots are taking care of you in the future. What you do with your new-found free time is in your hands (we hear it’s very cool to check out @joinmettle on Instagram…)

Let us know what you think

We love creating features that help you to run your business smoothly. If you’ve got any feedback about pots, or anything else, tell us via the in-app chat.