What is Strong Customer Authentication?

Mettle is for sole traders and limited companies with up to two owners (only one owner can access the account). You can have one Mettle account per person.

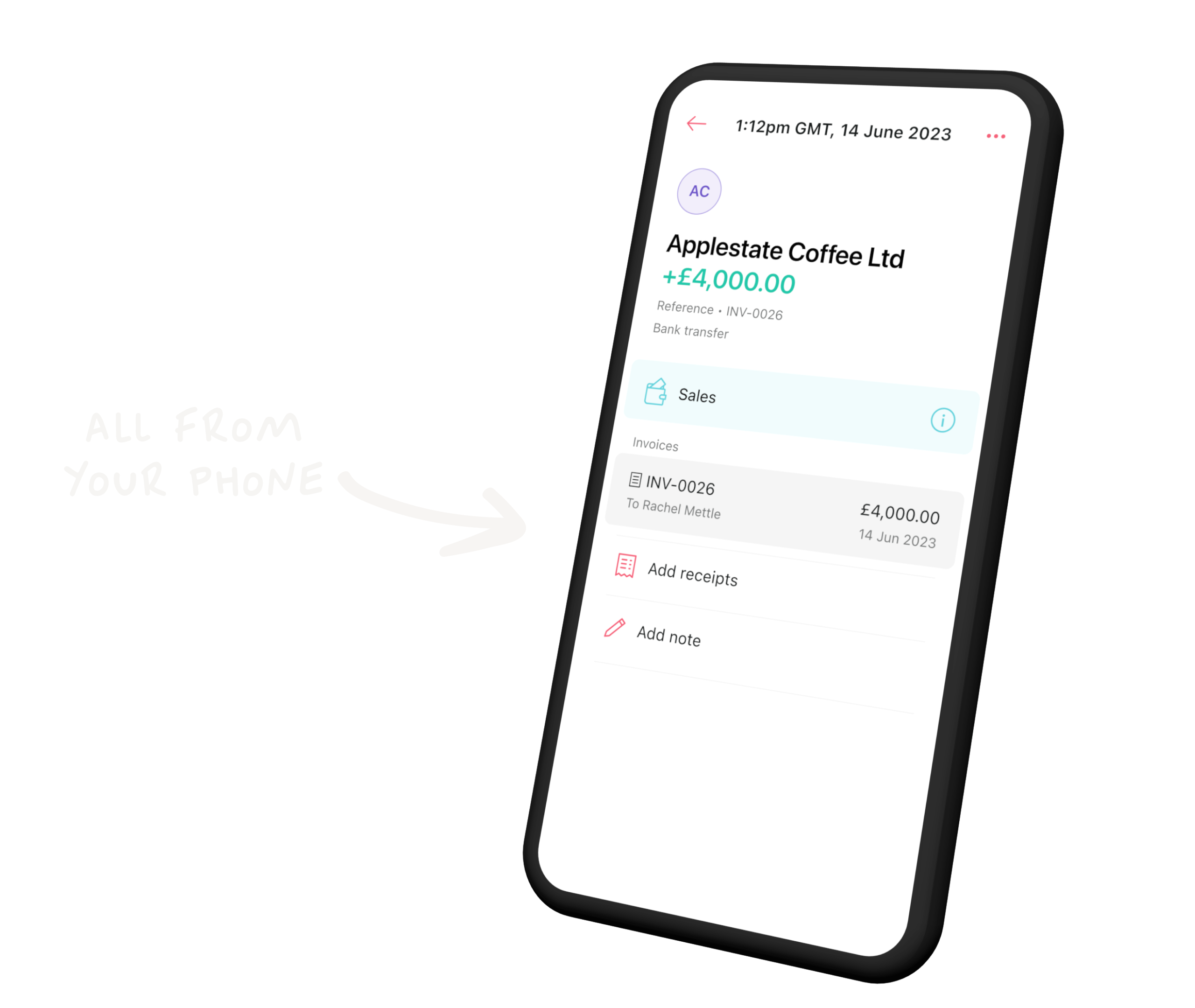

Just met a new client? You can now create and send quotes on the go and convert them to invoices in-app for £4 a month.

Mettle+ is an optional paid-for feature. You can cancel at any time. You'll need to be a Mettle customer to access Mettle+ which you can sign up for directly in the Mettle app.

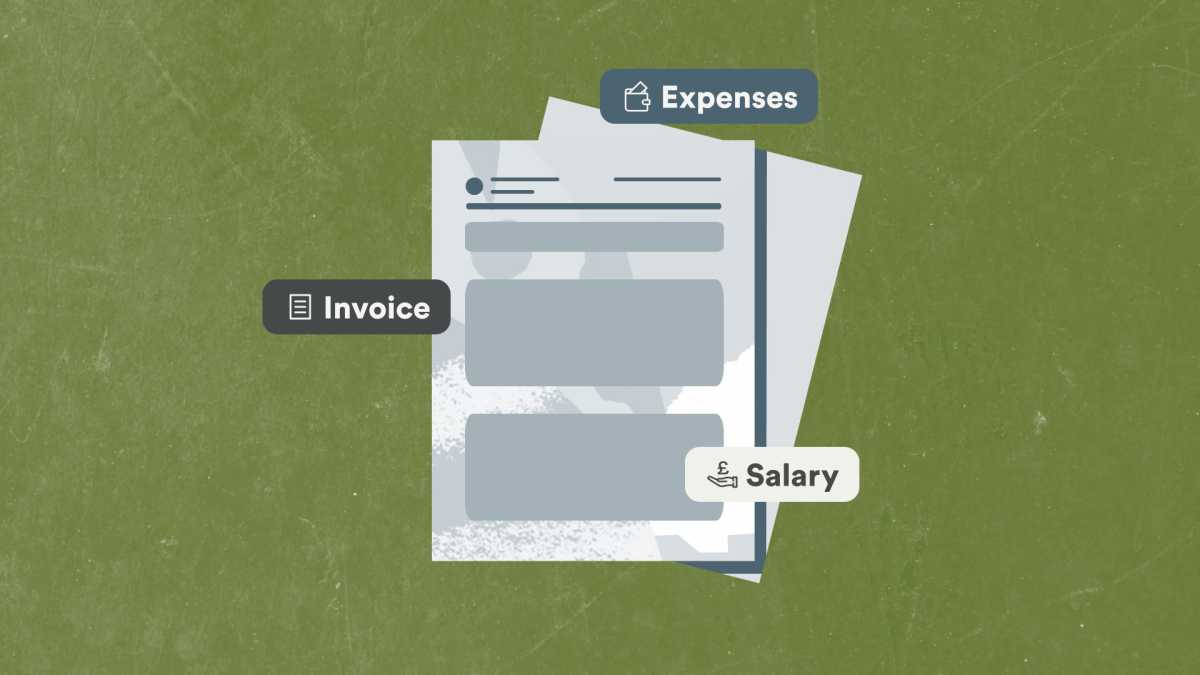

Manage your entire payment cycle – from creating an invoice to reconciliation.

Create and send customised invoices on the go. See what’s been paid and what you’re owed within one click. You can even track payments and chase late payers – all from your phone.

We'll notify you when money hits your account and match the payment to your invoice.

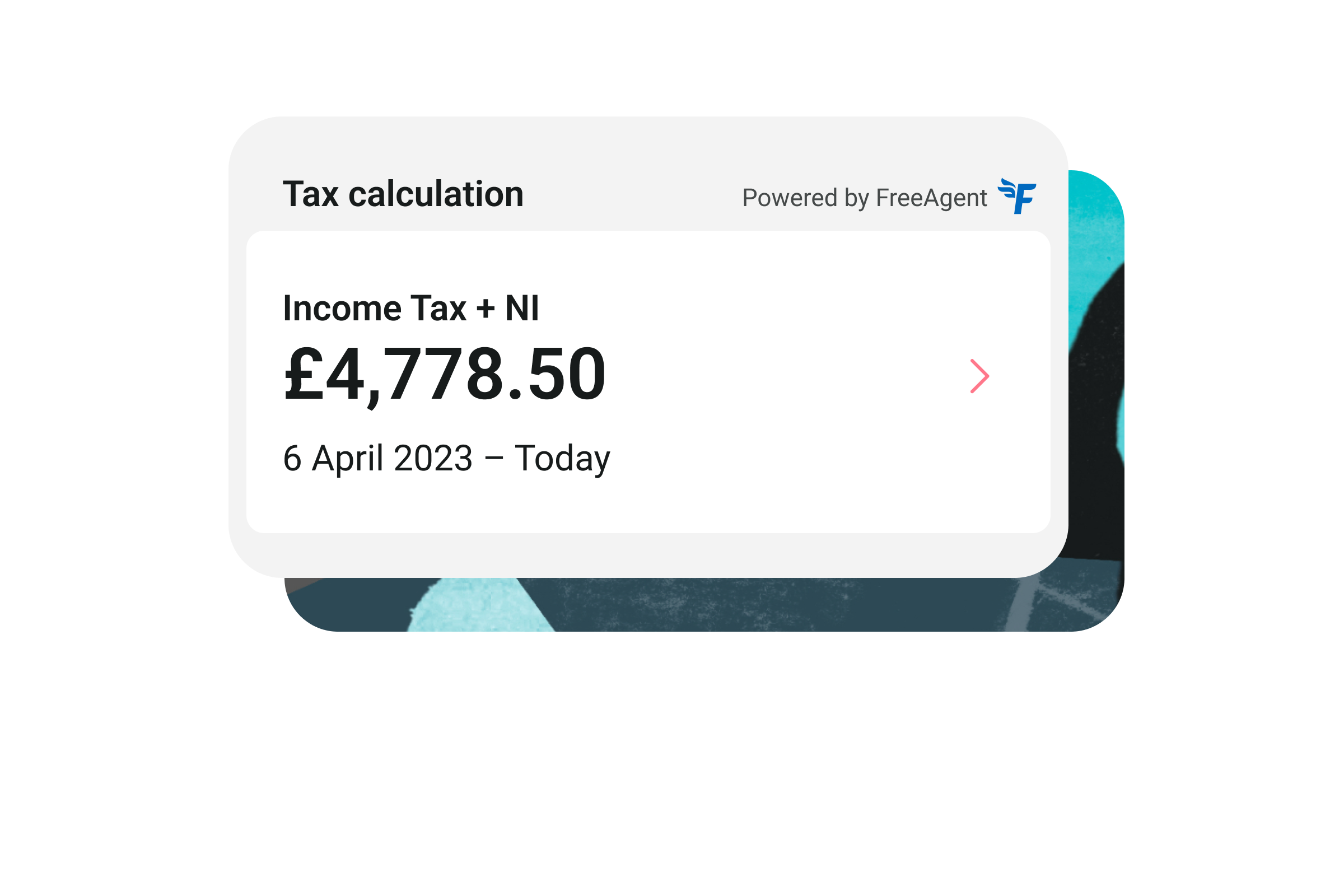

Learn more about the FreeAgent integration

Get a running total of how much tax you owe and when you need to pay it in the Mettle app, powered by FreeAgent.

It’ll help you stay on top of your tax all year round and avoid surprise tax bills.

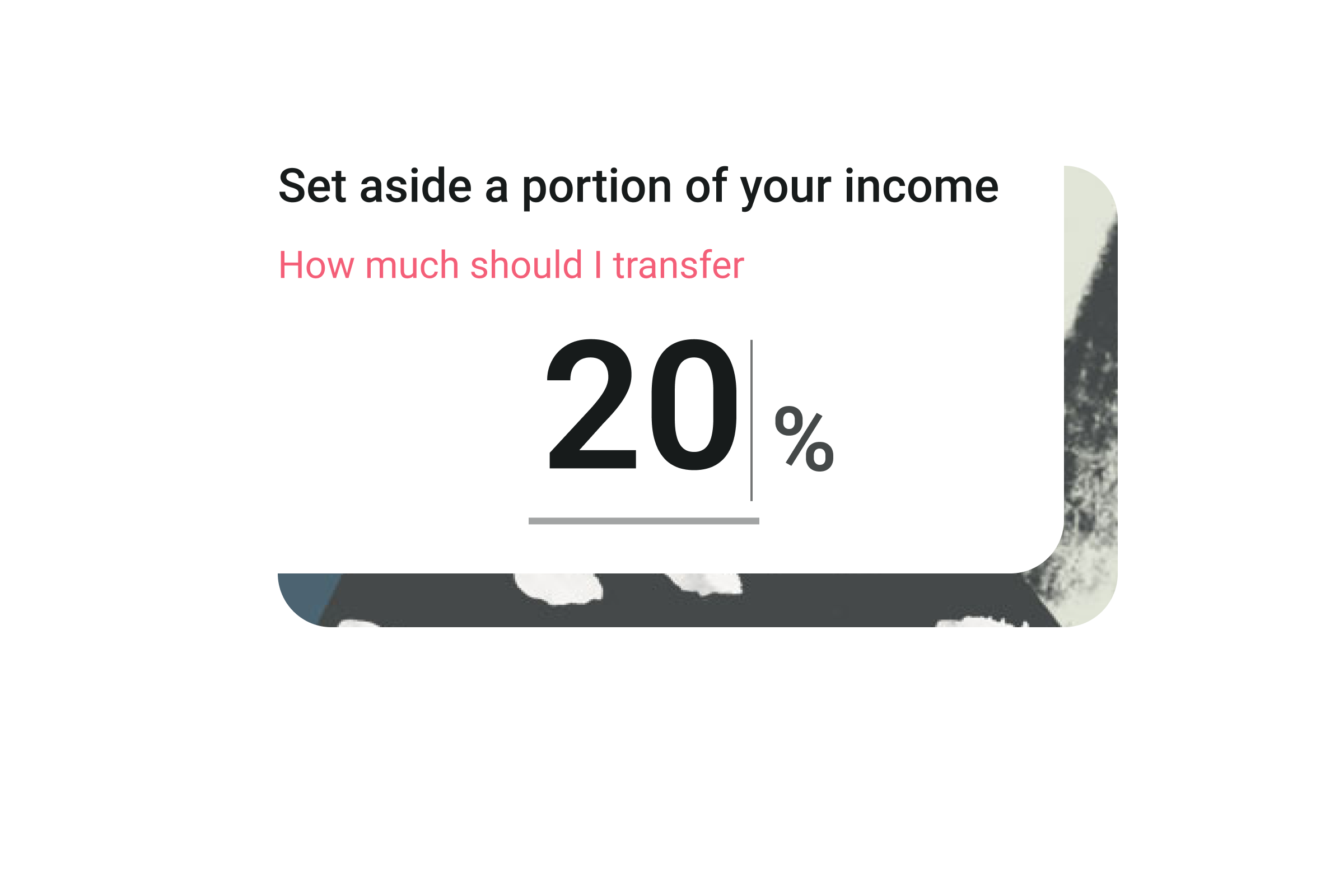

Easily put money aside from your main account into a Tax Pot. You can also set up a Scheduled Saver to save for business costs or new equipment.

Get tax tips and guidance in our tax hub

Have confidence knowing we're part of a trusted and regulated bank

Our team is here to support you whenever you need it.

Eligible funds protected up to £85,000 by the Financial Services Compensation Scheme (FSCS)

Mettle can close your account if you behave in an offensive, threatening or violent manner, which includes any racist or other discriminatory conduct, towards staff. See the T&Cs for more information.

What is Strong Customer Authentication?

What is Making Tax Digital and how will it impact you?

How to start an e-commerce business

Fraud updates and tips to stay safe

Black Friday: How to spot and report scams

What should I do if I'm missing a payment to my bank account?

Why you need a separate business account

The cost of registering a business in the UK